- Ripple case ruling brings clarity to digital asset industry.

- Stellar achieves milestone with successful launch of Soroban Preview Release 10.

- Stellar market experiences bullish rally, reaching 52-week high of $0.183.

The Ripple case ruling profoundly impacted the digital asset space, igniting a wave of excitement and discussion. Judge Torres’ decision, which categorically states that a digital asset should not be considered a security in and of itself, brought much-needed clarity to the industry. This long-awaited development has sparked optimism among industry professionals, who now anticipate a potential slowdown in the rapid regulatory changes that have been occurring.

Amid these advancements, Stellar directed its efforts towards enhancing utility and harnessing the potential of blockchain technology to pave the way for a more promising financial landscape. Furthermore, the Stellar ecosystem witnessed a noteworthy milestone with the announcement by Tomer Weller, a prominent Stellar developer, regarding the successful launch of Soroban Preview Release 10 on Futurenet.

Soroban, a smart contract platform built on Rust, has been developed to tackle the challenges of scalability and practicality. In addition to its seamless integration with Stellar, Soroban effectively addresses the issue of ledger bloat, a critical obstacle to the long-term viability of blockchain technology. Soroban incorporates a state expiration system that intelligently manages ledger space, ensuring efficient utilization and enabling restoration when required.

The introduction of Soroban v1, which has achieved stability and full functionality, represents a significant milestone following an extensive 15-month period of design refinements and public deliberations. As a result, the Stellar market has exhibited a bullish rally in response to this development, driving the price from an intra-day low of $0.09679 to a 52-week high of $0.183 within the past 24 hours.

At the time of reporting, the XLM market continued to be dominated by bullish sentiment, leading to a substantial surge of 54.83% to reach $0.1503.

If the bullish momentum surpasses the $0.183 mark, the next resistance level at $0.195 will likely come into play, potentially resulting in additional price appreciation for XLM. Conversely, if the price fails to breach the $0.183 threshold, a retracement towards the support level at $0.1400 may occur. This particular level has previously demonstrated robust support, thus attracting potential buyers and potentially curbing further downward movement.

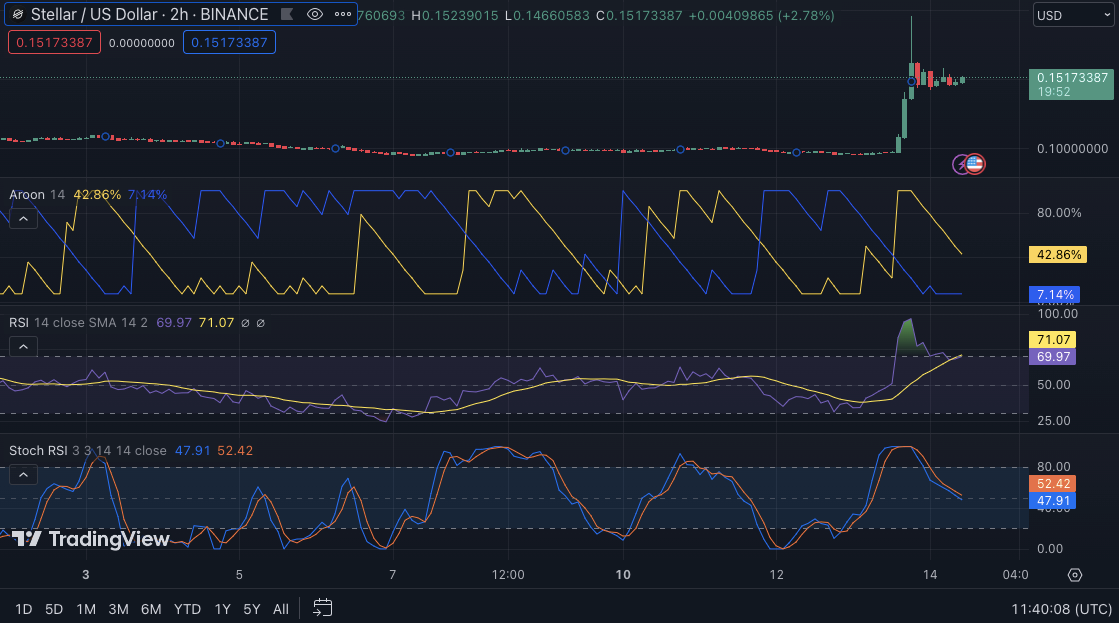

XLM/USD Technical Analysis

The stochastic RSI currently stands at 47.72 and shows a downward trajectory below its signal line, suggesting that the XLM market may soon witness a minor decline. Nevertheless, it is worth noting that the stochastic RSI is still within the neutral zone, which implies the potential for a market reversal or consolidation.

The Relative Strength Index (RSI) reading of 69.99 below its signal line indicates a potential bearish momentum in the XLM market. This could result in further downward movement shortly. However, it is worth noting that the RSI is still above the oversold level of 30, suggesting there is still buying pressure in the market.

The Aroon up indicator on the daily chart currently stands at 42.86, indicating a prevailing bullish sentiment in the market. However, it is important to note that this sentiment may weaken as the Aroon up value continues to decline. Conversely, the Aroon down value of 7.14% suggests the presence of bearish pressure, which could alter market sentiment if the strength of the bulls diminishes.

To summarize, Stellar experienced a significant upward trend, primarily fueled by the Soroban Preview Release 10 and favorable market sentiment, resulting in XLM reaching its highest point in the past 52 weeks. The prospects remain optimistic, with a potential resistance level at $0.195 and robust support at $0.1400.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.