- Gaming token Xai’s price fell over 10% after Binance listing.

- Xai Foundation’s airdrop of 125 million tokens caused market instability.

- Xai’s technical analysis shows bearish momentum with potential for short-term reversal.

The gaming token Xai, which operates on layer-3, experienced a notable decrease in its price, falling by more than 10%. This unexpected development occurred in the cryptocurrency market. This price reduction came shortly after the token was distributed through an airdrop and was listed on the prominent Binance exchange.

The abrupt response from the market has led to worry and conjecture among investors and those who analyze the market. As a result, the market value of XAI and its trading volume over 24 hours decreased by 9.93% and 58.32%, falling to $163,081,855 and $114,039,627, respectively.

Additionally, the choice by the Xai Foundation to carry out a significant airdrop of gaming tokens this year played a role in the market’s instability. 125 million XAI tokens were distributed to a chosen set of users, representing 5% of the overall supply. This group consisted of individuals who owned certain Xai NFTs and those who ran gatekeeper nodes or acted as validators. Prior to the airdrop, the market capitalization of Xai was over $154 million, but this number dropped sharply to about $70 million after the event.

Listing to Binance

Moreover, adding XAI to Binance was expected to be a beneficial development. The trading pair XAI/FUSD was introduced for spot trading, indicating an important advancement for Xai in terms of achieving widespread acceptance in the cryptocurrency market. Contrary to expectations of a rise in value, the token’s price declined.

Adding to the complexity, the market was also dealing with the appearance of a fraudulent XAI token. This imitation token plummeted to zero value after a substantial token exchange conducted by the creator’s address, according to PeckShieldAlert. The spurious token, initially confused with the authentic XAI, caused disarray and fear among investors, exacerbating the decline in the value of the legitimate XAI token.

XAI/USD Technical Analysis

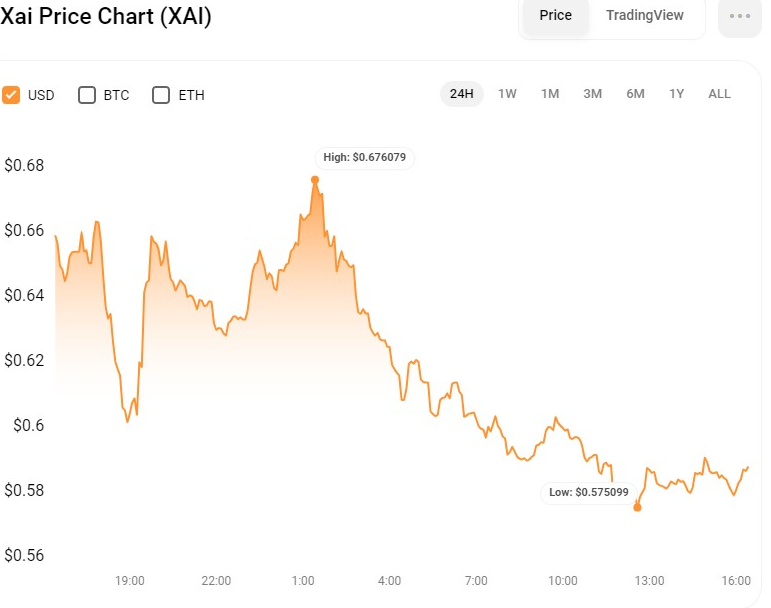

The RSI (Relative Strength Index) value 39.28 shown on the XAI/USD trading chart signifies an increasing bearish momentum. This trend implies that the force of market sales is growing, indicating a higher probability of further downward movements in price.

Should the RSI fall beneath the 30 mark, it suggests that the XAI/USD pair is entering an oversold condition. Such a scenario might entice purchasers seeking a deal, possibly causing a short-term downward trend reversal. Nonetheless, should the RSI persist in its descent, this could indicate an ongoing bearish movement, leading to additional price declines.

Moreover, the stochastic RSI figure of 10.54 indicates that the XAI/USD pair is presently in a state of being oversold. This pattern lends additional credence to the likelihood of a short-term pivot away from the downward trend, as purchasers might view it as a chance to buy in at a lower cost. This change suggests that sales momentum has diminished, which could result in reduced sell orders and a rise in buy orders.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.