The Shiba Inu (SHIB) meme coin has recently caught the attention of investors as a staggering 814 million SHIB tokens were burned. This impressive feat has been steadily increasing since the launch of the Shibarium testnet a few weeks ago, with a remarkable 10,000% increase in the amount of SHIB burned. This development is a testament to the coin’s growing popularity and potential to impact the crypto market significantly.

In a strategic move to decrease the token supply, a series of seven consecutive transactions resulted in the burning of a staggering 814,901,863 SHIB tokens. The largest burn occurred on March 27, with 794,858,822 tokens sent to dead wallets. The following day, the burn continued, with over 800 million tokens eliminated from circulation. This calculated effort to reduce the token supply demonstrates a commitment to the long-term success and stability of the SHIB ecosystem.

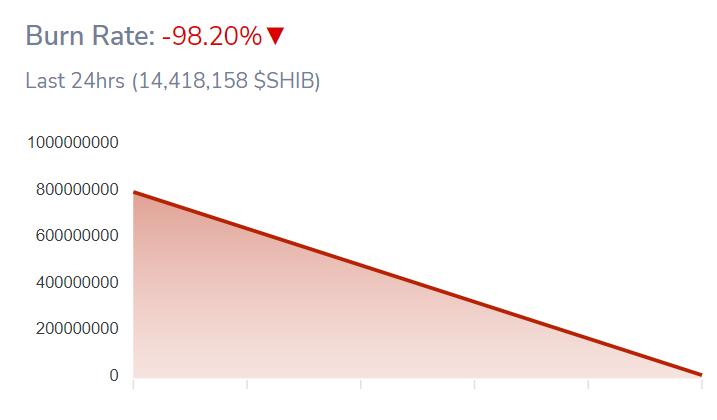

According to the Shibburn portal, the current burn rate has impressively plummeted by over 98%. As of now, a total of approximately 14 million SHIB tokens have been successfully burned.

Furthermore, alongside the escalation of the burn rate, there has been a noteworthy 5% surge in the count of SHIB holders who has attained the status of trillionaires in the last month. This upswing in SHIB whales could be a positive sign, suggesting a burgeoning fascination with the meme coin.

However, this development could raise concerns as it leads to a significant concentration of wealth among a select few, thereby creating opportunities for market manipulation and volatile price fluctuations.

The current trading price of SHIB stands at $0.0000108, reflecting a 4.45% surge in value over the past 24 hours. Despite this positive momentum, the meme-inspired cryptocurrency has experienced a slight dip of 0.62% over the last seven days. With a market capitalization of $6,366,474,259, SHIB ranks as the 14th largest digital asset in terms of market capitalization.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.