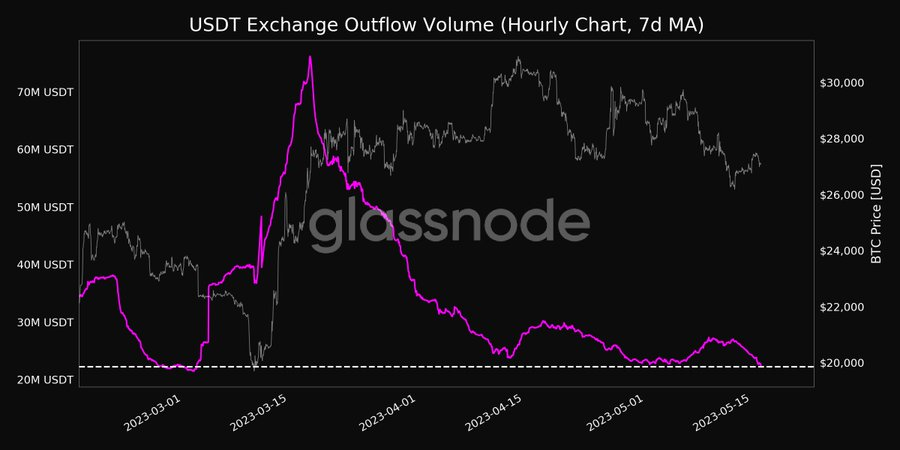

Glassnode Alerts, the esteemed on-chain analysis platform, has recently shared some intriguing data regarding Tether (USDT) on Twitter. Per their latest post, the exchange outflow volume (7d MA) for USDT has hit a one-month low, currently at 22,257,226.754 USDT. This information will greatly interest those keeping a close eye on the cryptocurrency market.

The current downtrend signifies a reduction from the preceding one-month nadir of 22,651,224.549 USDT documented on May 1, 2023. The outflow volume of USDT from exchanges hitting a fresh low indicates a decrease in individuals withdrawing or transferring USDT from digital currency exchanges.

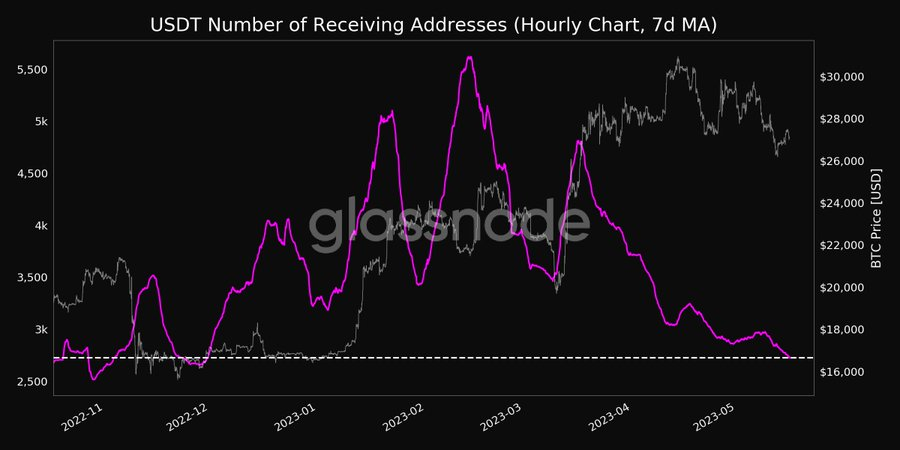

According to a recent tweet by Glassnode, the number of receiving addresses for USDT has hit a 5-month low of 2,724.173. This marks a slight decline from the previous 5-month low of 2,727.774, recorded on May 15, 2023.

The observed decrease in receiving addresses may imply a possible reduction in active USDT users or entities. This trend also signifies a waning demand for USDT or a shift in user preferences towards alternative cryptocurrencies or stablecoins.

The recent dip in both metrics highlights a sense of apprehension or ambiguity within the cryptocurrency market. Traders are exercising caution when making substantial transactions with their USDT, possibly due to the unpredictable nature of the market or external factors impacting the wider crypto landscape.

Upon perusing CoinMarketCap, the last 24 hours have been less than favorable for most cryptocurrencies. Regrettably, most of the top 10 cryptos, as determined by market capitalization, have experienced a decline in value over the course of the past day.

During the observed period, the top players in the market, namely Bitcoin (BTC) and Ethereum (ETH), both encountered a slight dip in their prices, with a respective loss of 0.85% and 0.62%. Conversely, other alternative coins such as XRP, Cardano (ADA), Polygon (MATIC), and Solana (SOL) experienced more significant price drops, exceeding 1%.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.