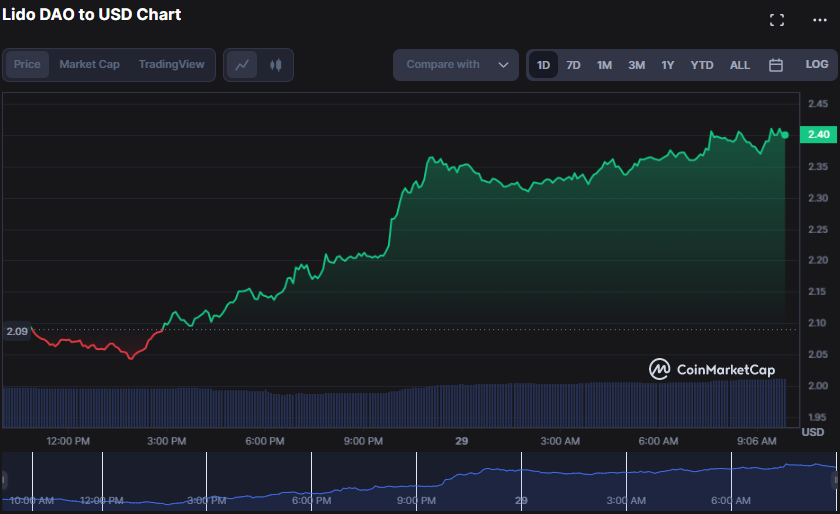

Despite a rocky start to the day, the bulls in the Lido DAO market managed to counteract the bearish trend that had caused the price to plummet to a 24-hour low of $2.04. This positive turn of events can be attributed to the Lido Node Operator Community Call #5, where the project’s future strategy and exciting advancements were discussed. This optimistic awakening bodes well for the market’s future and instills investors’ confidence.

The most recent advancements encompass the current state and progress of the Lido V2 testnet, a comprehensive walkthrough of the withdrawals process on Goerli, and a detailed update on the Lido DVT Testnet #2. These developments showcase our unwavering commitment to delivering cutting-edge solutions and continuously improving our services. We remain dedicated to providing our clients with the highest professionalism and expertise.

As a result of ongoing discussions, the LDO bulls have reached a new 7-day high of $2.41 before encountering resistance and settling at $2.40 as of press time. This marks a significant 14.97% increase from the previous closing, demonstrating the positive impact of constructive dialogue on market performance.

The market capitalization and 24-hour trading volume have experienced a notable surge, with a 14.92% and 22.00% increase, respectively. This impressive growth has brought the figures to $2,068,824,746 and $148,903,677, indicating heightened interest and engagement in DAO among investors and traders. This positive trend can be attributed to the favorable news and developments surrounding the project, which have undoubtedly captured the investment community’s attention.

The LDO 4-hour price chart has shown a promising development as the MACD line has crossed into positive territory, currently reading 0.039208131 and surpassing its signal line. This positive MACD movement clearly indicates the strengthening bullish momentum, which may present favorable buying opportunities for traders.

The upward trajectory of the histogram over the past few hours clearly indicates a bullish trend. This suggests that buying pressure is rising, and the price will likely continue its upward climb shortly. As such, this presents an excellent opportunity to initiate a long position.

The Bull Bear Power has surged to a reading of 0.31032473, propelling towards positive territory and signaling a bullish takeover in the market. This development suggests a greater likelihood of price appreciation, presenting a favorable opportunity for traders to contemplate a long position on LDO.

The current Relative Strength Index (RSI) trend shows an upward movement, with a reading of 65.10. This suggests that buying pressure is still prevalent in the market, and a further price increase is possible. However, traders should exercise caution as the RSI is nearing the overbought territory. It is important to remain vigilant and make informed decisions based on market analysis.

Although overbought conditions may suggest a potential price reversal, it’s important to note that this isn’t always the case. If the bull’s momentum remains robust and there’s no bearish divergence, the price may continue to climb despite being overbought. It’s crucial to closely monitor market trends and indicators to make informed investment decisions.

The current bullish momentum in the market is further strengthened by a Chaikin Money Flow reading of 0.05, suggesting that buying pressure persists and the price may continue to climb. However, a drop below zero in the Chaikin Money Flow reading could signal a shift in momentum and a potential reversal in price direction. It is important to monitor this indicator closely to make informed investment decisions.

To summarize, the recent advancements made by Lido DAO have ignited a positive market trend, presenting traders with promising prospects for investment.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.