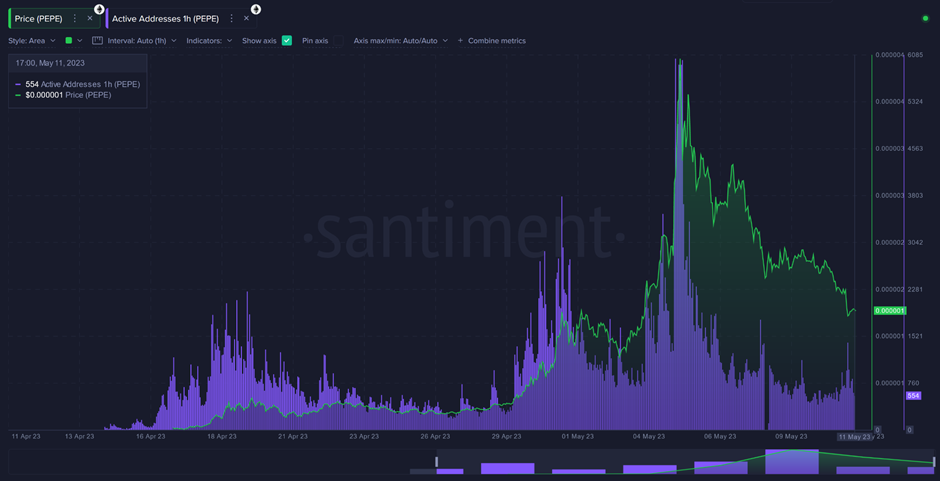

Santiment, the esteemed blockchain intelligence firm, has released its latest insights report on Pepe (PEPE) via Twitter this morning. The report is a timely response to the significant pullback in PEPE’s price, which followed its impressive +1,200% rally from 29 April to 5 May of this year.

Santiment’s analysis reveals that enthusiastic investors sought to capitalize on the recent downturn in cryptocurrency prices, anticipating a continuation of the impressive bullish trend. Regrettably, these attempts to seize the dip have proven ineffective, as significant addresses persist in offloading their PEPE holdings, per the report.

The sudden descent of the meme coin’s value was as swift as its meteoric rise, plummeting by approximately 65% from its peak on 5 May. According to the report, the firm’s social dominance metric had accurately predicted the altcoin’s downfall.

According to the indicator, PEPE’s social dominance experienced a decline from 5% to a range of 1-2% just hours before it reached its all-time high. This indicates that traders have begun to divert their focus towards alternative altcoins.

Moreover, the surge in PEPE’s value was accompanied by a significant increase in the number of distinct cryptocurrency addresses. Nevertheless, a meticulous analysis of this on-chain indicator exposed that prominent addresses had commenced offloading their assets just before the digital asset hit its zenith.

Santiment has warned that a surge in the number of sizable addresses possessing 100 million PEPE or above could signal a forthcoming secondary market downturn. It is anticipated that this subsequent sell-off will not be as severe as the previous one.

As of the latest update, PEPE is currently trading at $0.000001116, experiencing a significant decline of over 36%, according to CoinMarketCap. In the past 24 hours, this altcoin has also shown weakness against the two leading cryptocurrencies, with a drop of 33.80% against Bitcoin (BTC) and 33.60% against Ethereum (ETH).

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.