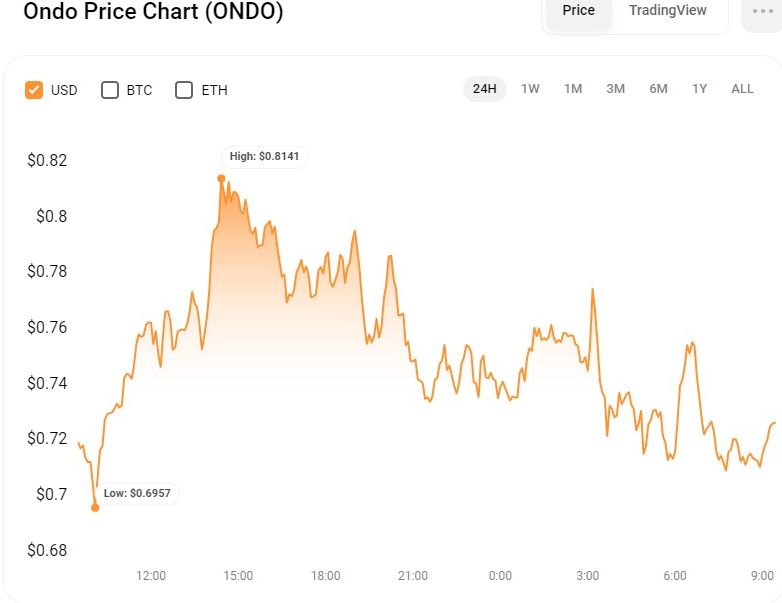

- ONDO token hits record high of $0.8162, trades at $0.7209.

- Whale transactions surge, exchange-held ONDO tokens decrease.

- Technical analysis suggests ONDO may be overbought, hinting at potential price correction.

The native token of Ondo Finance

Heightened Interest and Large Investor Transactions

The notable increase in ONDO’s value coincides with a surge in attention from major investors, or “whales,” who have been noted for their substantial trading volumes of the token. According to data from the cryptocurrency analytics firm Santiment, there has been a significant rise in large-scale whale transactions, specifically those exceeding $100,000 in ONDO, which have escalated from 68 to 91 distinct transactions over a single day. Such heightened involvement from major investors typically indicates potential price instability and can have a considerable impact on the market’s behavior.

Simultaneously with the uptick in whale activity, there has been a noticeable contraction in the number of ONDO tokens held on trading platforms. Santiment reports that the quantity of ONDO available on exchanges has decreased from 536.64 million to 529.60 million tokens since March 18. This pattern indicates an increasing tendency among investors to retain their tokens, likely expecting further price appreciation rather than selling them for immediate gains.

In response to these developments, the market has reacted favorably to ONDO’s price trajectory, elevating the token into the ranks of the top 100 cryptocurrencies by market capitalization. It now boasts a total market value of $1,048,138,273. This rise is a testament to the growing trust investors place in Ondo Finance and its tokenized asset offerings.

Expansion of Ondo Finance

Ondo Finance has been actively broadening its reach, particularly by expanding its real-world asset (RWA) tokenization offerings into the Asia Pacific market earlier in the year. This strategic move has opened doors for the platform to engage with a rapidly expanding market, allowing international investors to invest in U.S. asset classes via tokenization. Holding a reported 40% share in its market segment, Ondo Finance is reinforcing its status as a prominent entity within the decentralized finance (DeFi) ecosystem.

Recent events, particularly BlackRock’s application for the BlackRock USD Institutional Digital Liquidity Fund in collaboration with Securitize, have brought attention to the tokenization of real-world assets (RWA). As Ondo Finance is active in this area, the growing interest in tokenized assets across the market could be advantageous for the platform’s ongoing expansion and the value of its proprietary token.

Technical Analysis for ONDO/USD

The current technical analysis, using tools like the Relative Strength Index (RSI) on the 4-hour ONDO/USD price chart, which shows a rating of 81.21, suggests that the token might currently be in an overbought condition, potentially leading to a near-term decline in its price. This situation could allow investors to buy in at a more favorable price during the anticipated correction before the token potentially resumes upward movement.

Additionally, the Money Flow Index (MFI) score of 89.21 increases the probability of a price decline. This particular MFI score indicates that the token is currently experiencing substantial buying pressure, which could ultimately decrease the price as traders decide to realize their gains.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.