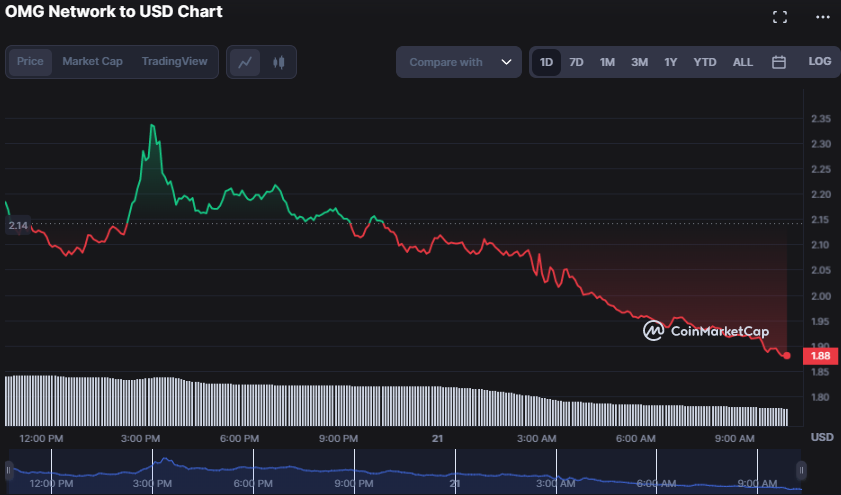

The bullish momentum propelling the OMG Network (OMG) forward came to a halt as the bulls could not break through the resistance at the intraday high of $2.34. This unfortunate turn of events allowed the bears to take control of the market, resulting in a significant drop in the OMG price. As of press time, the value had plummeted to a 24-hour low of $1.88, marking a 12.62% decrease. It’s a challenging time for OMG, but we remain vigilant and professional in analyzing the situation.

The decline in OMG’s value could be attributed to the actions of short-term traders who seized the opportunity to cash in on the earlier upward trend. Consequently, the market capitalization and 24-hour trading volume experienced a decline of 13.41% and 65.41%, respectively, settling at $264,409,223 and $373,031,756. These figures indicate a significant shift in the market, and investors need to remain vigilant and informed in their decision-making.

Should the current bearish trend persist, the $1.88 support level will likely be breached, paving the way for subsequent support levels at $1.80 and $1.75. This could trigger a surge in selling pressure within the market.

If the bulls reclaim their dominance and successfully breach the $2.34 resistance level, the price trajectory could lead towards the subsequent resistance levels at $2.50 and $2.70. This would undoubtedly attract a surge of additional buyers, thereby amplifying the market’s positive momentum.

According to the 2-hour price chart of OMG, the Relative Strength Index (RSI) is currently below its signal line, standing at 44.80. This indicates a potential oversold zone of 30, suggesting that the bearish trend in OMG may persist for a while. As a result, traders are advised to exercise caution before taking any long positions until the RSI shows signs of a possible reversal.

The MACD line has slipped below its signal line, plunging into negative territory with a value of 0.0372640. This development paints a somber picture, suggesting that bear power is rising, and the price may soon experience a further decline. This could present a lucrative opportunity for short-selling.

The current trend of the histogram is displaying a negative trajectory, which suggests a rise in selling pressure, which could lead to a further decline in price.

As the Bollinger bands widen and the negative momentum persists in the OMG market, astute traders may find it opportune to short OMG and capitalize on the downward trend. It is advisable to set a stop loss above the upper Bollinger band to mitigate risk. The upper band currently sits at 2.3674781, while the lower band rests at 1.8188315, indicating the extent of this movement.

According to the Fisher Transform trend analysis, the current value of -3.68 below the signal line suggests that the market is oversold. This could present a buying opportunity for traders. However, it is advisable to exercise caution and wait for confirmation before initiating any transactions. As a professional, making informed decisions based on reliable data and market trends is important.

The Bull Bear Power indicator currently stands at -0.2228581, indicating a negative trend in the market. This reinforces the oversold state and suggests that bears are currently in control. As a result, traders are advised to exercise caution and wait for a bullish signal or reversal pattern before taking any long positions. This is because the market may continue to decline in the near future.

Although the current market indicators suggest a prolonged bearish trend, it is imperative for the bulls to persistently work towards reversing the negative trajectory of the OMG market.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.