- Terraform Labs files for Chapter 11 bankruptcy, LUNA price drops 7%.

- Do Kwon retains 92% ownership of Terraform Labs amid bankruptcy filing.

- LUNA trading volume surges 53.05% despite market capitalization falling 6.16%.

The price of Terra (LUNA) has declined more than 7% after the latest announcement that Terraform Labs, the organization responsible for the TerraUSD (UST) stablecoin, has declared Chapter 11 bankruptcy. This declaration was made in a court in Delaware on January 21 and represents a significant event for the company based in Singapore, which Do Kwon established.

Bankruptcy Safeguard Sought by Terraform Labs

While facing continuous legal disputes, such as a legal action filed against the U.S. Securities and Exchange Commission, Terraform Labs has filed for Chapter 11 bankruptcy protection, according to Coin Edition. Do Kwon continues to be the principal owner with a 92% stake in Terraform Labs, and the rest of the equity is owned by Daniel Shin, an entrepreneur from South Korea.

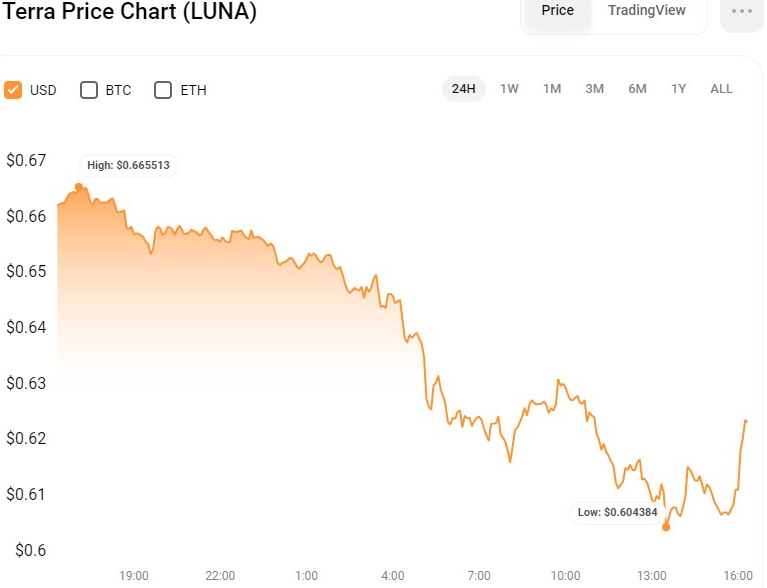

The announcement that Terraform Labs has gone bankrupt has created disturbances within the Terra network. As a result, the Terra (LUNA) cryptocurrency, which was already facing difficulties in the market, experienced an additional 7% drop in its value, descending from a daily peak of $0.6662 to a daily trough of $0.61. At the time of reporting, LUNA was trading at $0.6209, representing a 6.28% fall from its highest value in the past 24 hours.

Moreover, LUNA’s market capitalization decreased by 6.16% to $395,792,889, mirroring the overall negative sentiment. Yet, the trading volume over 24 hours rose 53.05%, reaching $45,133,733, showing heightened activity and attention towards the LUNA token even as its value declined. The surge in trading volume suggests that certain investors might consider the current downturn an opportunity to buy LUNA at a reduced cost, which could help its recovery.

Similarly, Terra Luna Classic (LUNC) saw its value fall, reaching $0.000102. The trading volume of LUNC has been reduced by 1%, contributing to the prevailing market ambiguity.

LUNA/USD Technical Analysis

The LUNAUSD price chart shows the stochastic RSI trend in the oversold territory, indicated by a value of 8.60, which is currently on an upward trajectory. This could imply that a price reversal or upward bounce for LUNAUSD might be forthcoming. As a result, traders and investors could see this as an opportunity to buy or accumulate LUNAUSD, expecting an imminent rise in its price. Additionally, a rise in trading volume corroborates the potential for a reversal in price, reflecting an increase in interest and trading activity for LUNAUSD.

The RSI, or Relative Strength Index, with a value of 25.52 that is climbing, also indicates the possibility of a price turnaround for LUNAUSD. Should the RSI exceed the 30 mark, which is considered the threshold for being oversold, this might indicate a change in momentum favoring buyers, possibly resulting in a rise in LUNAUSD’s price. Moreover, the rising RSI implies that the cryptocurrency might be shifting into a bullish period, which could draw additional investors and further increase its price.

Moreover, the Chaikin Money Flow (CMF) value, which is currently at -0.08 and trending higher, points to a possible purchase point for LUNAUSD. The favorable CMF indicates that money is entering the market, which strengthens the possibility of a price turnaround. Should the CMF persist in its ascent, this may be a robust sign of growing demand from buyers and the potential for additional increases in LUNAUSD’s price.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.