- Litecoin (LTC) nears its third halving event.

- Previous halvings led to substantial price upswings for LTC.

- Traders optimistic about LTC price movement despite technical indicators.

As Litecoin (LTC) nears its upcoming third halving event, there has been a surge in discussions surrounding the potential replication of historical price performance. To provide context, the halving occurs at four-year intervals. It entails a process wherein miners receive rewards for verifying transactions.

In the past, it has been observed that LTC experiences a pre-halving rally followed by a subsequent decline in price a few days after the event. CoinMarketCap data supports this trend, as evident before the August 5, 2019, halving. During this period, LTC demonstrated significant growth, from approximately $88 in July to trading above $120 on the halving day.

LTC is not in harmony with history

Nevertheless, despite being one of the trailblazing cryptocurrencies, LTC has yet to experience a similar surge in this market cycle. It is worth noting that previous halvings have consistently led to substantial price upswings. However, compelling indicators indicate a potential deviation from this pattern in the current scenario.

As an example, the current market value of the coin stands at $93.29, reflecting a notable decline of 12.80% over the past 30 days. As of the time of this analysis, Litecoin (LTC) has not exhibited any significant indications of surpassing the psychological barrier of $100.

Before the event, the market dynamics of the coin indicated a tendency towards a neutral signal rather than a bullish or bearish inclination. Based on the Exponential Moving Average (EMA) analysis of the daily LTC/USD chart, this inference was drawn.

On July 30, the 20-day exponential moving average (EMA) (represented by the blue line) intersected the 50-day EMA (represented by the yellow line). Traditionally, such a crossover is considered a bullish indication, further supported by a significant buying candle that reached $109.08. Nevertheless, the bullish momentum was short-lived as a multitude of selling pressure emerged, causing Litecoin (LTC) to decline to $93.36.

Traders have faith in a breakout

Moreover, there has been a convergence between the 50-day Exponential Moving Average (EMA) and the 20-day EMA. If the 50-day EMA surpasses the 20-day EMA, Litecoin (LTC) could likely experience a decline below the $90 level.

In the crypto industry, the Chaikin Money Flow (CMF) registered a value of 0.04, indicating a positive market sentiment. This suggests that there is strength in the market. However, further buying pressure is required to validate a potential upward breakout.

Based on the current market conditions, the decreasing trading volume and the converging momentum indicate that the possibility of a sudden upward surge appears unlikely.

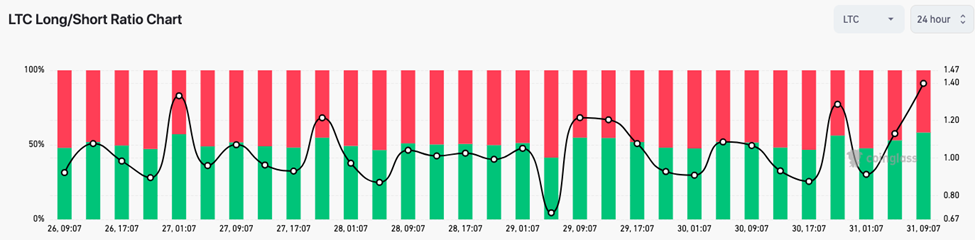

Despite the technical indicators suggesting otherwise, traders in the crypto industry appeared to be optimistic about the price movement of LTC. Coinglass reported a significant rise in the LTC 24-hour long/short ratio, which now stands at 1.39.

A long/short ratio above 1 indicates a greater abundance of long positions, indicating a positive sentiment in the derivatives market for LTC. Conversely, a ratio below one signifies a higher prevalence of short positions, suggesting a more negative sentiment. Therefore, based on the LTC open positions in the derivatives market, there is a positive sentiment among professionals in the crypto industry.

In summary, LTC probably will stay within the $100 mark before the halving. However, considering the current positioning of traders, there exists the potential for a subsequent surge in the coin’s value in the weeks following the event, assuming sellers do not exert overwhelming influence over buyers.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.