- Bitcoin Cash’s 30-day performance records an impressive surge of approximately 149%.

- BCH surpasses $300 mark on June 30, showcasing growing demand and recognition.

- BCH’s funding rate decline suggests prevailing dominance of short traders.

Bitcoin Cash (BCH) has encountered a retracement following a prolonged bullish streak. Despite the subsequent price decline, the coin’s 30-day performance has recorded an impressive surge of approximately 149%.

Including BCH in the EDX Markets exchange launch played a significant role in the rally of Bitcoin’s (BTC) 2017 hard fork. This development led BCH to surpass the $300 mark on June 30, showcasing the growing demand and recognition for cryptocurrency in the crypto industry.

Quick rally not guaranteed

In addition, CoinMarketCap disclosed that the BCH/KRW trading pair experienced the most substantial trading volume on the prominent South Korean exchange, Upbit. This notable development played a pivotal role in the cryptocurrency’s subsequent recovery on July 6, following an initial downturn.

However, despite maintaining its position among the top two cryptocurrencies in terms of trading volumes on Upbit, the price of BCH had experienced a decline to $282 at the time of writing.

On the 4-hour BCH/USD chart, the Chaikin Money Flow (CMF) has declined to -0.04, suggesting a potential weakening of BCH’s market strength as it crossed below the zero line.

Moreover, this indicated a greater prevalence of capital outflows rather than inflows, indicating a preference for distribution over accumulation. Consequently, the upward trajectory of BCH may encounter significant obstacles due to diminishing demand.

The chart above also took into account the volatility of BCH. By analyzing the Bollinger Bands (BB), it was observed that the coin’s volatility started to decrease when selling pressure emerged at approximately $297.21 on July 3.

Nevertheless, the immense market pressure exerted on BCH resulted in an excessive selling frenzy, causing the price to plummet to a significant low of $262.42, breaching the lower band. Subsequently, the market contraction eased slightly, and it is worth noting that the BCH price managed to avoid reaching either the lower or upper band. Consequently, it is plausible to anticipate that the coin will likely undergo a period of consolidation shortly.

Expecting a further decline?

Moreover, the Moving Average Convergence Divergence (MACD) experienced a significant decline, reaching a critical level of 0.67. Concurrently, market participants witnessed a fierce battle between buyers and sellers as the orange and blue dynamic lines converged, indicating a struggle for control.

Nevertheless, the fact that the MACD remains above zero suggests a stronger inclination towards bullish sentiment rather than a bearish signal. However, it is important to note that any potential increase in the BCH price may be relatively modest.

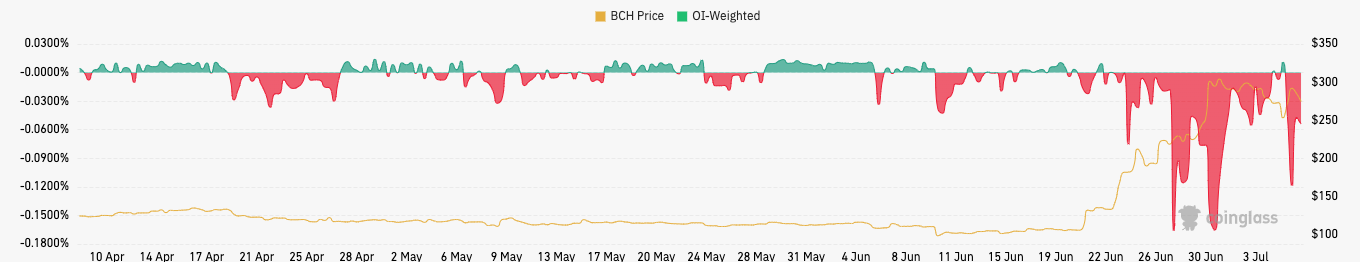

In the crypto industry, it is worth noting that BCH’s 8-hour funding rate has currently declined to $274. This funding rate represents the variance between the perpetual price of a particular asset and its spot price.

A positive funding rate in the crypto market typically indicates a bullish sentiment among traders. However, the recent decline in BCH’s funding rate suggests a prevailing dominance of short traders. Consequently, the broader market anticipates a further downward movement in the cryptocurrency’s value.

In summary, it is advisable for investors anticipating BCH to reclaim the $300 threshold to exercise patience as the technical analysis suggests the possibility of consolidation or a potential decline below its present value.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.