- Dogecoin rebounds above $0.6 mark after experiencing an 11% decline.

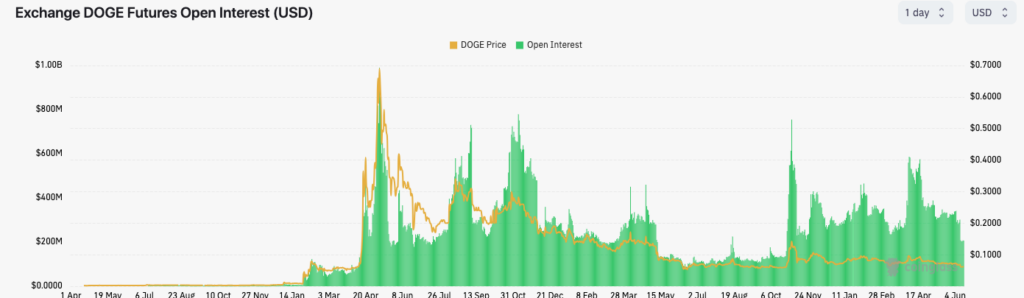

- Open interest of DOGE has been on a downward trend since May.

- Over half of all Dogecoin holders are currently experiencing losses.

Over the past month, Dogecoin (DOGE) has experienced an 11% decline in value, largely attributed to the market’s widespread volatility. This resulted in the meme-inspired cryptocurrency hitting a yearly low of $0.059 on June 10th. However, recent market stability has allowed DOGE to rebound above the $0.6 mark.

Although DOGE has witnessed significant price surges throughout the year, reaching the $0.1 mark may be more arduous. This projection is primarily based on the prevailing market sentiment and the demand for DOGE.

As per the reputable derivatives information hub, Coinglass, it has been observed that the open interest of DOGE has been on a downward trend since May.

Skipping the long and shorts

Open interest is crucial in determining the market’s dedication to a specific cryptocurrency. It represents the number of active long or short contracts in the options or futures market. A surge in open interest typically indicates a rise in trading volume, reflecting a growing interest in the asset. As such, monitoring open interest can provide valuable insights into market sentiment and potential price movements.

In the case of DOGE, the decrease in the metric, coupled with a downward price trend, suggests that traders are divesting their holdings. Furthermore, the growing proximity of positions validates that the present price trajectory may be reaching its conclusion.

Before the sudden plummet of the candle on June 10th, the 4-hour DOGE/USD chart indicated that the cryptocurrency had maintained a narrow trading range between $0.0671 (support) and $0.0714 (resistance).

The surge in resistance before the drawdown proved a significant obstacle for the bullish market, impeding its progress towards the coveted $0.072 mark.

DOGE may bounce if this indicator rises

Although DOGE has experienced a period of consolidation during the market’s resurgence, purchasing momentum has encountered resistance multiple times at the $0.0626 mark. However, if the bulls can successfully shift the RSI’s direction upwards, there is potential for DOGE to surpass the $0.0626 resistance level.

Given the consistent demand and a reassuring RSI rebound from 35.50, DOGE may reach $0.0720, contingent upon the stabilization of Bitcoin (BTC) and the wider market.

Upon analyzing the Fibonacci retracement level, it was observed that the 4-hour chart indicated a DOGE $0.616 price below the 0.618 level.

If the selling pressure surpasses the buying pressure and the RSI experiences a retracement, a slight pullback may occur. Additionally, the range from 0.0573 to 0.0584 presents a potential entry point.

Despite the unpredictable trajectory of DOGE’s future trends, the recent plummet has significantly impacted the portfolios of numerous holders. Data from IntoTheBlock indicates that over half, specifically 51.74%, of all Dogecoin holders are currently experiencing losses.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.