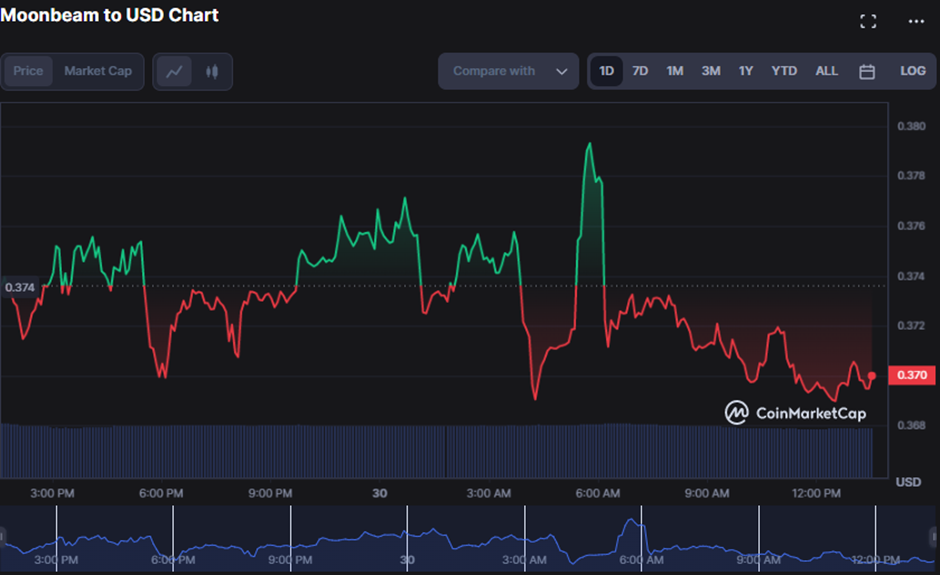

Despite bullish efforts to overthrow the bearish dominance in the Moonbeam (GLMR) market, sturdy resistance at the intraday peak of $0.3795 has impeded progress. Following the bulls’ inability to invalidate the bearish grip on GLMR, the price dipped to a 24-hour low of $0.3686 before recovering with support.

Despite the ongoing dominance of bears in Moonbeam, the price has experienced a decline of 1.09%, currently standing at $0.3686. Should this trend persist and the support level of $0.3686 be breached, it is advisable to keep a close eye on the subsequent levels of $0.3558 and $0.3429. However, if the bears lose momentum and the bulls regain their footing, the price may recover toward the resistance levels of $0.3825 and $0.3962. As always, it is important to remain vigilant and informed in the market’s ever-changing landscape.

Amidst the economic downturn, the market capitalization and 24-hour trading volume experienced a slight dip of 0.88% and 13.52%, respectively, settling at $224,101,074 and $7,426,918. This decline indicates the prevailing pessimistic sentiment among traders who are offloading their assets, leading to a reduction in both market capitalization and trading volume.

The Vortex Indicator has shown promising signs for GLMR as it has crossed above its signal line with a reading of 1.0939. This suggests that the bearish momentum may be subsiding, paving the way for a potential trend reversal to the upside. Such a development has bolstered traders’ confidence in the Moonbeams’ upward potential, potentially attracting more buyers and driving up the price. These indicators encourage investors to seek to capitalize on the market’s potential.

Moonbeams’ momentum is rising, as evidenced by the impressive Rate of Change reading of 1.86. This positive movement suggests the investment option holds great potential for traders seeking substantial gains shortly. With such strong momentum, Moonbeams is a compelling choice for those looking to make a smart investment move.

The anticipation stems from the conviction that a favorable ROC trend indicates an upward asset value trajectory. Consequently, astute long-term investors who purchase at a low price and hold steadfastly can expect a promising rate of return.

Based on the Aroon up reading of 71.43 and the Aroon down reading of 21.43%, GLMR’s bearish momentum may persist for some time. However, these readings do not suggest a significant long-term downtrend. As a professional observation, it is important to continue monitoring the market trends and indicators to make informed investment decisions.

The anticipation of a potential market upswing is rooted in the Aroon up, which signals the enduring strength of the preceding uptrend despite the current bearish momentum. Conversely, the Aroon down suggests a relatively feeble bearish trend that could reverse shortly. These technical indicators provide valuable insights for informed investment decisions.

The stochastic RSI has recently fallen below its signal line, indicating a reading of 75.50. This development suggests that the bearish trend may persist, casting a shadow over the short-term outlook. As a result, traders may wish to reassess their positions.

The anticipation of a prolonged bearish trend is rooted in the stochastic RSI’s descent below its signal line, which suggests a dearth of buying momentum and the possibility of further market downturns.

Despite the recent downturn in the market, Moonbeam’s positive momentum indicators indicate a potential for an upward trend, making it a highly attractive investment opportunity.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.