- Binance Coin (BNB) outperforms Bitcoin, indicating a reaccumulation phase, not distribution.

- BNB’s price surges to $604.17, with market cap increasing to $88.482 billion.

- Technical analysis shows bullish trend, but RSI indicates potential short-term pullback.

Binance Coin

After reaching its highest level, BNB went through a considerable decline, yet it was resistant to a complete collapse until it hit a crucial juncture during the second quarter of 2022. This tendency to recover was reflected again in 2023, exhibiting a pattern that did not align with the traits of distribution. The examination highlights that after the key periods in the second quarter of each year, BNB was set for a recovery.

BNB’s robust standing is further reinforced by the successful breach of the critical price range from $300 to $360, paving the way for a more unobstructed journey towards record highs. Market observers eagerly awaited the conversion of this key threshold.

Although BNB has not yet reached its highest price point, the current trend indicates that a decisive breakthrough could lead to a reaccumulation phase, potentially driving the digital currency to unprecedented levels.

BNB’s Market Performance

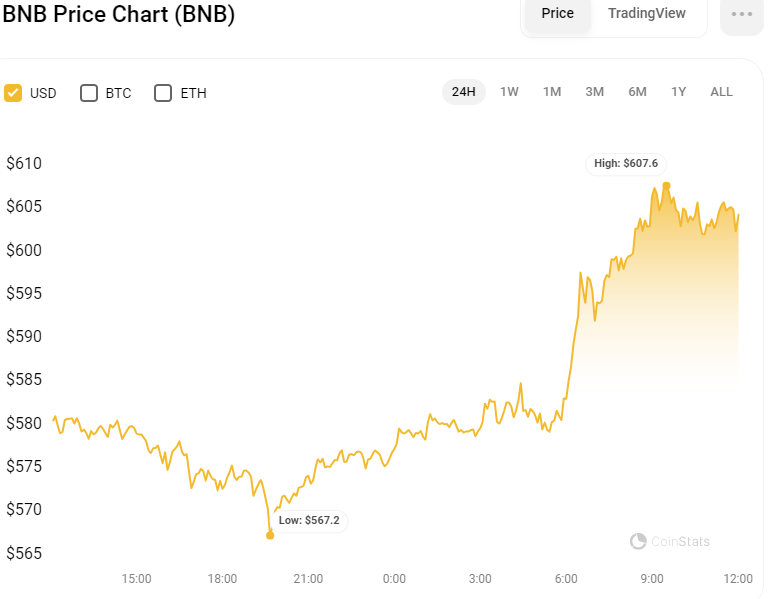

The BNB digital currency is on an upward trajectory, indicating a potential reversal of past downturns. At the time of reporting, its price increased by 4.2% within a day, now at $604.17. Concurrently, the market capitalization of BNB, which represents the aggregate value of all issued BNB tokens, has also seen a 2.20% increase, amounting to $88.482 billion.

Moreover, there has been a significant increase in the level of trading activity, with the BNB trading volume in the last 24 hours escalating by 5.29%, reaching a total of $1.2033 billion. This surge implies that investors are showing greater interest and are engaging more in BNB transactions, signaling an optimistic sentiment in the marketplace.

From a technical analysis perspective, the BNB cryptocurrency is exhibiting a pronounced upward trend, as evidenced by the Moving Average Convergence Divergence (MACD) indicator. Observing the 4-hour chart, the MACD line is surging well above the signal line, which is positioned at 11.2, indicating a robust bullish sentiment in the market. This indicates the potential for BNB’s price to experience further increases shortly. Reinforcing this bullish outlook, the presence of green bars on the MACD histogram suggests that the market is being dominated by buyers.

Conversely, the stochastic Relative Strength Index (RSI) presents a more complex scenario. In spite of widespread market confidence, the RSI signals that the asset is in an overbought state, with a value of 89.19. Additionally, placing the ‘K’ line beneath the ‘D’ line in this overbought territory suggests the potential for a short-term price pullback or a stabilization period as the market adjusts to its recent upward movement.

However, the prevailing positive sentiment in the market suggests that any such downward adjustments are expected to be brief, with the asset’s price expected to continue its ascent in the foreseeable future.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.