- Bitcoin shows unusual stability, fluctuating between $69,000 and $64,000.

- Potential surge if Bitcoin breaks $70,000 resistance, says analyst Captain Faibik.

- Glassnode report reveals shift in Bitcoin supply dynamics, indicating market changes.

Bitcoin

Investors and cryptocurrency enthusiasts have been eagerly tracking Bitcoin’s price activity, especially as it nears crucial resistance thresholds. Analysis from Captain Faibik, a respected figure in the cryptocurrency community, suggests that Bitcoin could be on the cusp of a substantial price surge if it manages to breach the resistance level at $70,000. This potential for significant upward movement in Bitcoin’s price should inspire hope and excitement among investors.

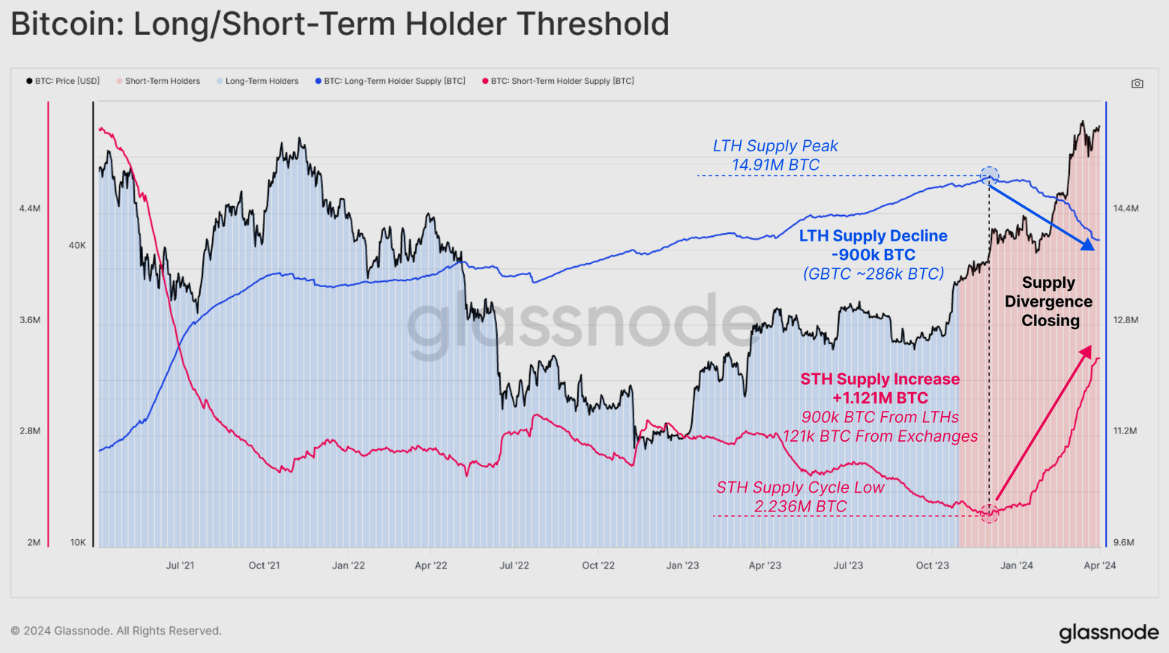

This perspective aligns with the broader anticipation of increased market volatility, which could reshape the current market outlook. A recent analysis from Glassnode offers a comprehensive view of the factors driving this shift, enriching the understanding of Bitcoin’s position in the market. The report highlights a notable shift in the supply dynamics of Bitcoin, as evidenced by on-chain metrics, ensuring that investors and enthusiasts are well-informed about the evolving market conditions.

The analysis notably reveals the reactivation of previously dormant Bitcoin supply after a period of exceptional scarcity, providing crucial insights into the behavior of the cryptocurrency market. The convergence of supply held by Long-Term Holders (LTH) and Short-Term Holders (STH) is becoming more pronounced, a situation that often arises when prices surge and unrealized profits entice LTHs to sell their holdings. This observation should alert investors and enthusiasts to potential shifts in the market.

Since the end of 2023, the supply of Bitcoin held for the long term (LTH) has significantly declined, with a reduction of 900,000 BTC from its highest point of 14.91 million BTC. Importantly, withdrawals from the GBTC trust account for about one-third of this decrease, representing approximately 286,000 BTC.

In contrast, the supply of Bitcoin held for the short term (STH) has increased by 1.121 million BTC. This increase has compensated for the decrease in LTH supply and included an additional 121,000 BTC that were acquired from secondary markets via exchanges.

The trend of moving away from long-term investment to more short-term, speculative activities suggests a shift in the Bitcoin market dynamics. The analysis presented in the report, which examines the ratio of LTH to STH supplies, supports the notion of this shift, indicating a general movement towards distribution, taking profits, and speculation when the market is on an upward trend.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.