- Bitcoin may hit downside target of $24K, says analyst.

- Tether’s allocation of profits towards BTC seen as positive for industry.

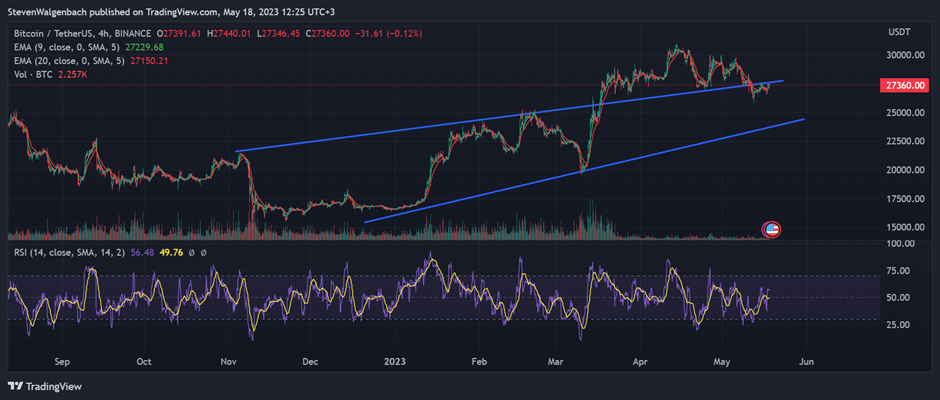

- BTC must break out of current channel to avoid dip to $24K.

According to the latest crypto trader and analyst Dan Gambardello’s analysis, Bitcoin (BTC) may still hit a downside target of $24K in the coming weeks. While he cannot provide a full guarantee, Gambardello believes that a drop to this level is a logical prediction from a macro perspective. His insights offer valuable perspectives for those closely monitoring the cryptocurrency market.

During the video, Gambardello mentioned Tether’s latest declaration to allocate up to 15% of their profits towards the purchase of BTC. This move was perceived as a positive indication for the cryptocurrency industry. However, it is worth noting that BTC’s price has recently retreated to a long-term channel established in November of last year.

The trader issued a cautionary note, stating that BTC’s price must break out of its current channel to avoid a potential dip to $24K. However, if BTC manages to break out of the channel promptly, it could soar to $33.5K in the coming months, as per Gambardello’s analysis. Nevertheless, BTC must first establish the 20-day and 50-day EMA lines as support on its journey towards $33.5K.

As of publication, BTC is currently valued at $27,361.08, reflecting a 1.92% surge in the last 24 hours. Impressively, the market leader outperformed its major rival, Ethereum (ETH), by 0.83% within the same timeframe. These developments signify a promising outlook for BTC and its investors.

In conjunction with the surge in price, BTC experienced a notable uptick in its daily trading volume within the past 24 hours. Consequently, BTC’s cumulative daily trading volume reached an impressive $14.9 billion.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.