- Arbitrum (ARB) price drops 9% in 24 hours, 24% over the week.

- ARB market cap hits record high despite token price decline.

- Whale investors move 58 million ARB tokens to trading platforms.

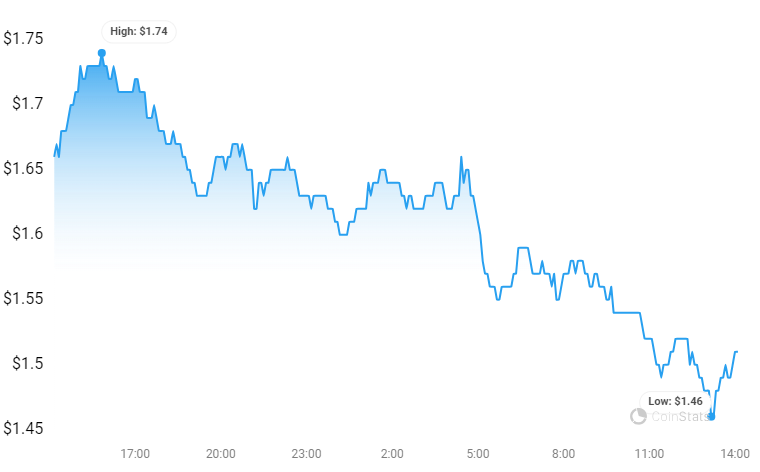

The price of Arbitrum

This downward price movement follows a significant development for Ethereum’s Layer-2 scaling solution, which involved a token unlock on March 16. Nevertheless, the market capitalization of Arbitrum has reached a new record high.

Arbitrum’s Token Unlock

Arbitrum has entered a pivotal stage in the growth of its ecosystem with the initiation of a “Cliff Unlock” event, which introduced 1.1 billion ARB tokens into the market. This substantial addition of tokens was allocated to the project’s team, advisors, and investors, which has led to concerns about its effect on the market.

The allocation included 673.5 million tokens for the project’s internal stakeholders and 438.25 million for investors. The token unlock often leads to worries about a potential sell-off that could negatively affect the token’s price.

Despite expectations of a price decline, Arbitrum’s market capitalization saw an 88% increase, taking its value beyond the $3.99 billion threshold. This growth in market cap, even with a decrease in the token’s price, indicates strong demand and investor confidence in Arbitrum’s future prospects and its contribution to the blockchain industry.

At the same time, the 24-hour trading volume experienced a 66% increase, reaching $1,181,818,256, which shows heightened investor confidence in the ARB token’s ability to recover. Nevertheless, on April 16, another scheduled unlock of 92.65 million ARB tokens, which have a current market value of about $157 million, is scheduled.

Whale Transactions

Data from Lookonchain revealed that a group of large-scale investors, or “whales,” transferred approximately 58 million ARB tokens to trading platforms. This amount is only a small portion of the total unlocked tokens, indicating a more complex investor reaction to the token unlock event.

Additional data showed an increase in the volume of ARB transactions, surpassing $1 million on the day the tokens became available, suggesting a surge in trading by major investors. At the same time, there was a rise in the count of wallets holding a large quantity of ARB tokens, which suggests that some prominent investors may be choosing to gather more or maintain their current stock despite the fluctuations in the market.

ARB/USD Technical Analysis

The ARB/USD pair’s 24-hour chart shows the Relative Strength Index (RSI) declining, with a current value of 26.56, which points to the asset being in an oversold state. This condition is often seen as an opportunity for traders to buy in anticipation of a potential price recovery. The trend indicates that the downward momentum could be losing strength, and a reversal in price might occur if buyers step in to leverage the oversold situation.

The Money Flow Index (MFI) value at 33.43 implies a potential for a price turnaround, hinting that the selling force might be diminishing. Should the MFI persist in its descent into the oversold territory beneath, this may indicate additional downward trends prior to an eventual price correction.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.