- ADA’s value peaked at $0.715 in March, now trading at $0.4625.

- ADA’s market cap fell to $16.685 billion, with a 23.13% drop in volume.

- Technical analysis suggests potential decline to $0.40 if current support breaks.

During the initial three months of 2024,

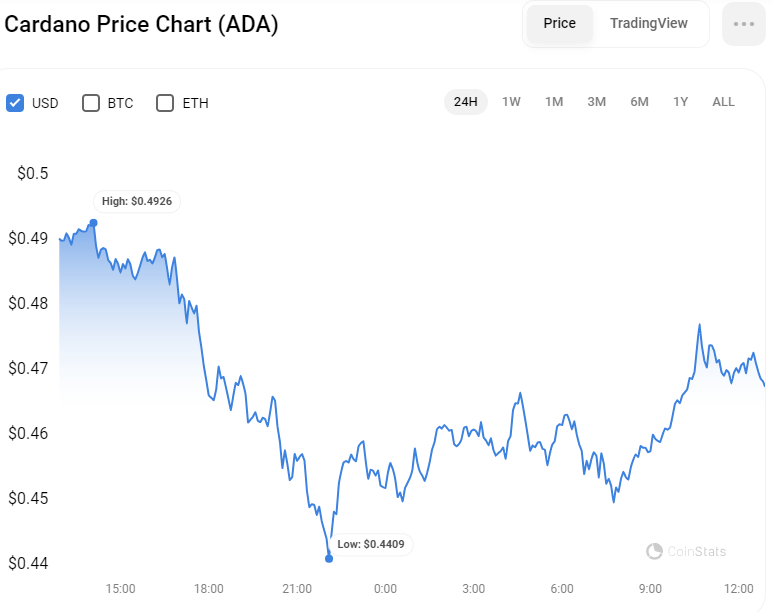

At the time of reporting, ADA’s trading price was $0.4625, which represents a decline of 5.75% from the price 24 hours prior. This downturn signifies the ongoing difficulties ADA faces in attempting to reach its earlier peak prices. Nonetheless, when compared to Bitcoin, ADA has shown a degree of resilience and steadiness, with a modest gain of 1.06% relative to Bitcoin, potentially indicating a more solid foundation for future appreciation.

Conversely, ADA’s market value has declined by 4.46% today, falling to a market cap of $16.685 billion. ADA’s trading volume has also decreased by 23.13%, reaching $647.482 million in the past 24 hours, signifying a reduction in trading activity.

Similarly, the current trading range for ADA is acting as pivotal support and resistance zones. Should the downward trend persist, ADA’s value might approach the lower end of today’s trading range at $0.4409. On the flip side, a surge in price would encounter resistance at the day’s peak.

ADA/USD Technical Analysis

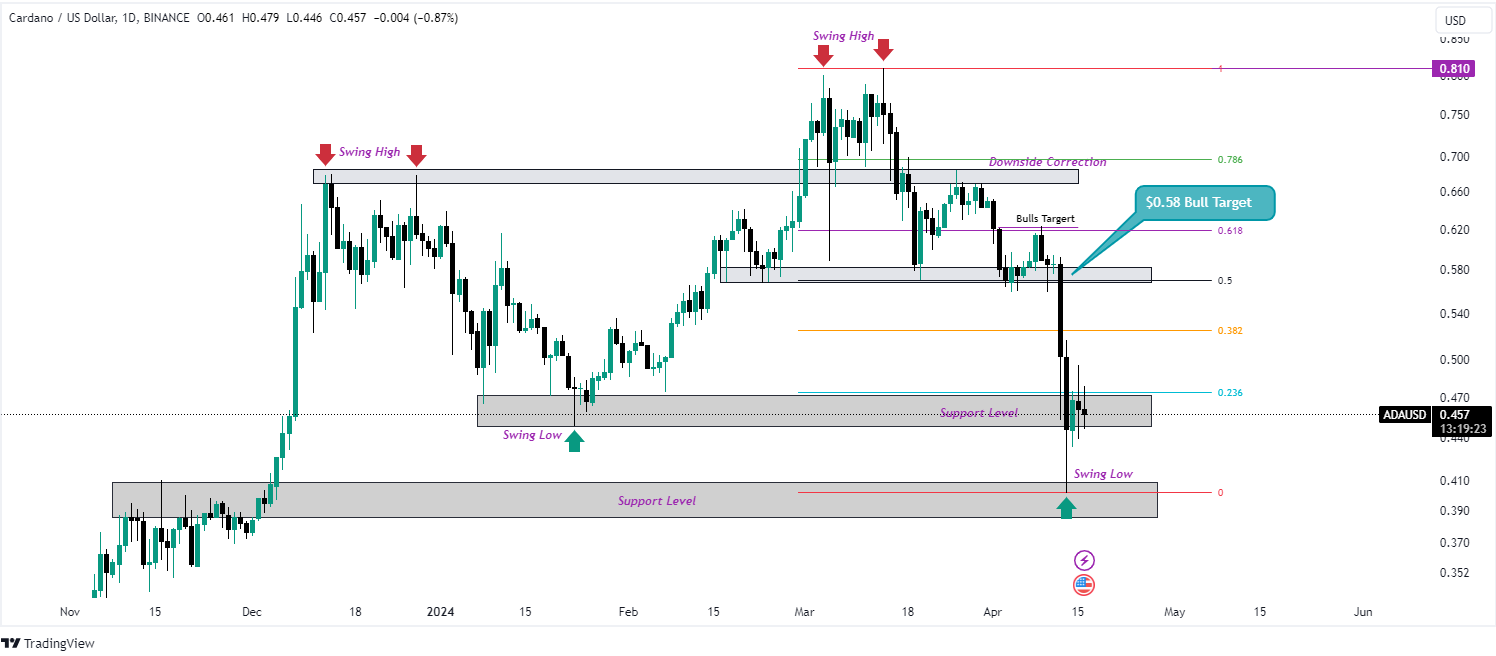

The ADA token is exhibiting signs of a downtrend on the daily chart, with the price showing fluctuations and a general downward trajectory since March 14. Recent observations indicate that ADA’s price found a level of stability in a new support zone between $0.472 and $0.448 after breaking through a previous support level. This stability points to a potential period of consolidation, as the token has avoided a further decline to the stronger support level at $0.40, which has remained intact against additional decreases.

Despite the market’s instability, should a positive trend emerge, ADA might aim for the $0.58 resistance zone. This level is crucial as it aligns with the 50% Fibonacci retracement mark, derived from a recent high of $0.810 and a low of $0.401. Surpassing this point could signal a shift to a bullish trend, potentially leading to higher price objectives.

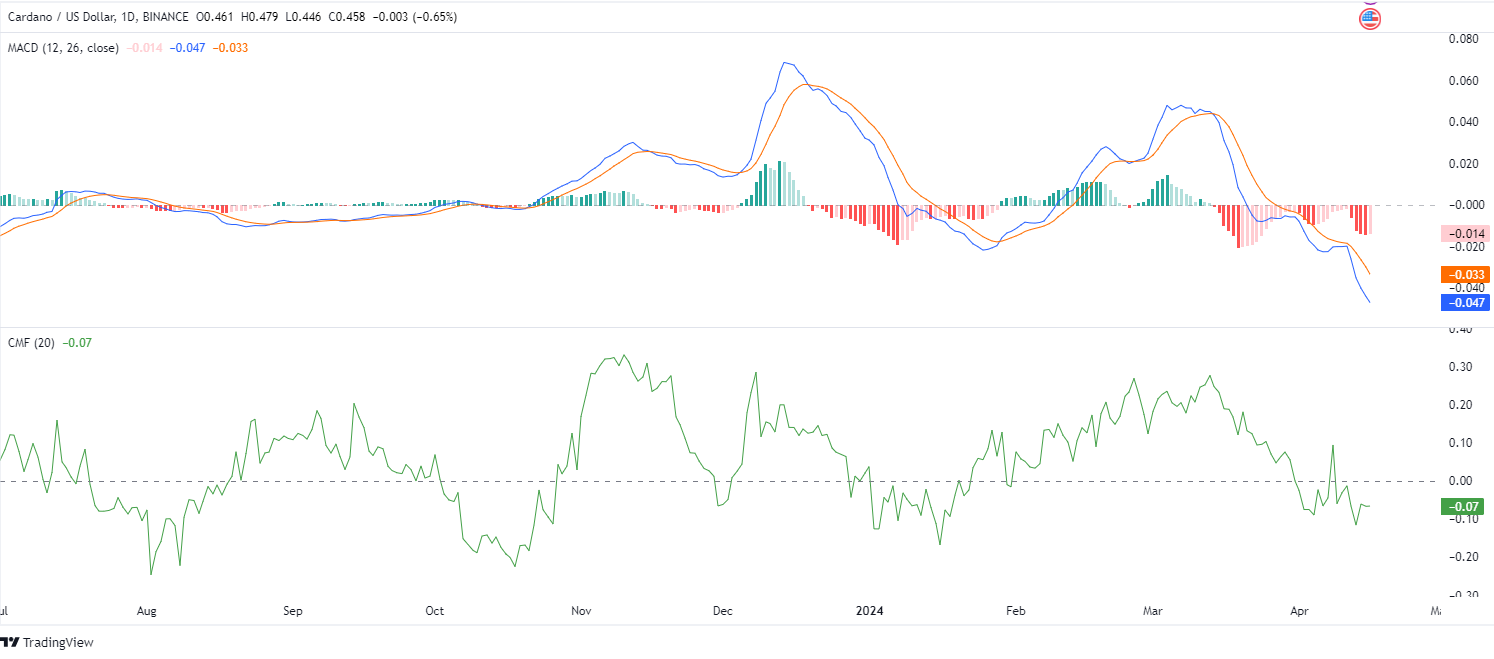

On the other hand, if the price falls beneath the present support of $0.448, it could approach the $0.40 mark, suggesting further declines could be in store. Important technical indicators corroborate this pessimistic outlook. The Moving Average Convergence Divergence (MACD) indicator is trending sharply lower in the negative territory at 0.047, signifying intense selling activity.

The increasing length of the red bars on the histogram, which are located beneath the zero line, supports the likelihood of ongoing downward trends. Furthermore, the position of the Chaikin Money Flow (CMF) indicator is under the zero line, showing a value of -0.07. This indicates that more money is exiting ADA than entering, further confirming the current negative market outlook.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.