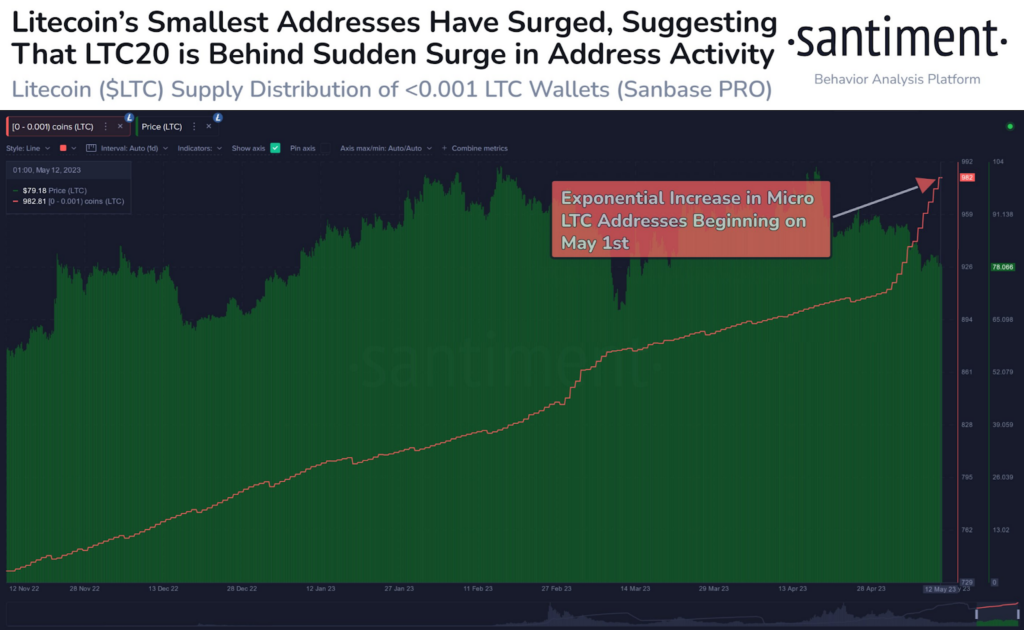

Santiment, a leading blockchain intelligence firm, has released its latest insights report on Litecoin (LTC) via Twitter. The report delves into the recent surge in active addresses on the Litecoin network, which has garnered significant attention in the industry. This timely analysis arrives three months ahead of the network’s highly anticipated halving event in August. As a trusted source of information, Santiment’s report provides valuable insights for investors and enthusiasts alike.

As highlighted in the tweet, the surge in active addresses has led to a notable uptick in network activity and a shift in supply distribution. The remarkable rise in micro LTC addresses has been of particular interest, denoting addresses holding less than 0.001 LTC since May 1st, 2023.

According to Santiment’s report, the surge in micro wallets on the Litecoin network can be attributed to the recent introduction of LTC20, an experimental standard for non-fungible tokens (NFTs). This conclusion was drawn based on the observation that the rise in active addresses on the network coincided with the buzz surrounding LTC20 within the Litecoin community. The data suggests that the adoption of LTC20 has had a positive impact on the network’s user base and overall activity.

As of publication, LTC was exchanging hands at $80.33, having experienced a 2.66% surge in the past 24 hours, as per CoinMarketCap. Impressively, the altcoin managed to outdo Bitcoin (BTC) by 0.48%. However, it fell short of Ethereum (ETH), with a 0.39% decline against the top altcoin.

LTC is hovering near its daily peak of $80.74, indicating a potential for a fresh daily high in the upcoming hours. Conversely, its 24-hour low was recorded at $77.85. With a market capitalization of roughly $5.85 billion, LTC currently holds the 13th position. It trails behind TRON (TRX) and leads ahead of Binance USD (BUSD).

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.