- The Sandbox (SAND) is facing a potential bearish trend due to the impending release of 372 million tokens.

- The release of these tokens, which constitute 18.1% of the overall supply, has historically negatively affected SAND’s market value.

- Despite potential losses, projections suggest that SAND could stabilize within the $0.39 to $0.41 range.

The digital asset market frequently undergoes periods of expectancy and conjecture in the face of significant token unlocks. The Sandbox

Token Unlocks reports that 372 million SAND tokens are scheduled for unlocking on August 14. To clarify, token unlocking is a term used in the crypto industry to describe releasing a certain amount of tokens that a project has previously held under certain restrictions. Once these tokens are unlocked, they become tradable in the market.

In the context of The Sandbox, the impending release of 372 million tokens constitutes 18.1% of the overall supply. The project team will also receive 71 million SAND, with the foundation being allocated 37 million. The remaining tokens will be distributed among consultants and reserved for the project’s future needs.

Historically, the release of SAND tokens has negatively affected its market value. Consequently, there was conjecture that the impending token unlock could disrupt SAND’s relatively stable price trajectory.

Intriguingly, the 4-hour SAND/USD chart indicates a relatively low level of volatility surrounding the token. This suggests the potential for minimal price fluctuation, assuming the Bollinger Bands (BB) maintain their current volatility level as we approach the unlock period.

Should SAND maintain its current volatility levels, its price could range from $0.39 to $0.41. As of the latest update, the Awesome Oscillator (AO) stood at 0.000484. Despite the AO being in the green zone, the initial bullish crossover appears to be losing momentum.

The configuration of the indicators exhibited a downward trend with red candlesticks, indicating a potential selling opportunity before the token unlock. As observed in past unlock events, there is a high probability of encountering substantial selling pressure. Should this scenario occur, SAND could depreciate to as low as $0.35.

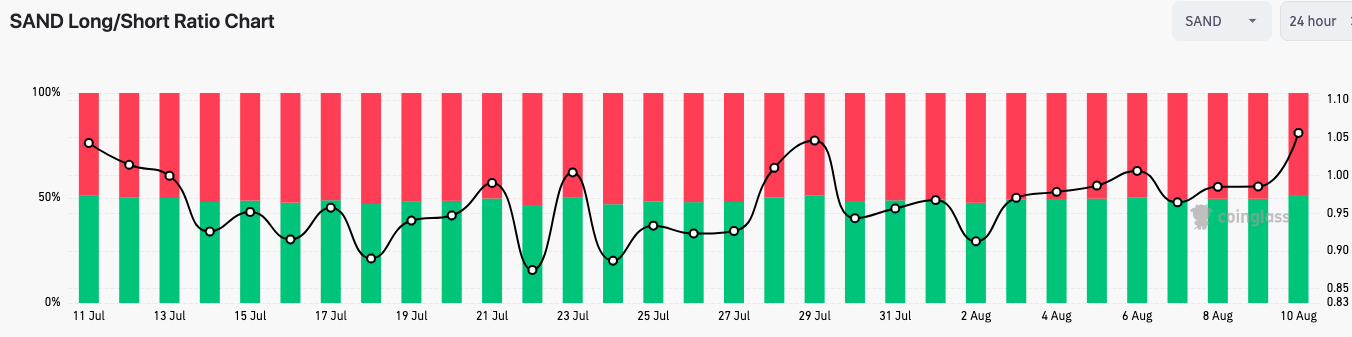

Concurrently, participants in the derivatives market are unfazed by the prospect of a potential bearish trend. Coinglass data indicates that at the time of reporting, the long/short ratio for SAND stood at 1.05, suggesting a lack of concern among traders.

The long/short ratio is a valuable tool for gauging the overall sentiment of traders towards a particular asset, indicating whether the market is bearish or bullish. A value below 1 signifies that the prevailing open position leans towards bearish. However, in the context of SAND, the scenario is quite different, with long positions outnumbering short ones.

In summary, the impending unlock of the SAND token may result in insignificant losses for those holding or trading the token long-term. As previously indicated, projections suggest that SAND could stabilize within the $0.39 to $0.41 range.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.