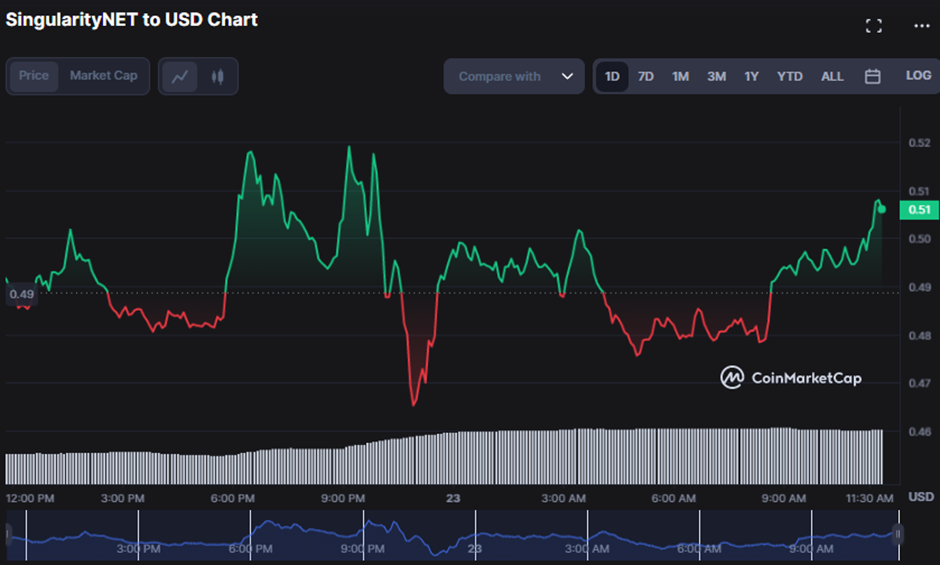

The SingularityNET (AGIX) market has witnessed a fierce battle between the bulls and bears in the last 24 hours, resulting in price fluctuations ranging from $0.5197 to $0.4643. However, the bulls have emerged victorious, with AGIX trading at $0.5074, reflecting a 3.15% surge. This development indicates a positive trend in the market, and investors can expect a stable and profitable future for AGIX.

If the AGIX market remains under bullish influence, the following resistance levels to be surpassed after $0.5197 would be $0.5263 and $0.5329. Conversely, should the bears take charge, it is advisable to keep a close eye on the support levels of $0.4972 and $0.4906. As always, it is essential to remain vigilant and informed to make sound investment decisions.

As the trading day commenced, market participants were optimistic about AGIX’s prospects, anticipating a prolonged bullish trend. The market capitalization and 24-hour trading volume surged by 2.83% and 79.70%, respectively, reaching $611,859,213 and $313,925,982. This remarkable upswing indicates that investors have faith in AGIX’s future and are willing to allocate more funds. The heightened level of activity and interest in AGIX could boost market liquidity and foster price stability. Overall, the market sentiment towards AGIX appears positive, reflecting a promising outlook for the asset.

According to the AGIX price chart, the Keltner Channel is expanding, indicating sustained positive momentum in the foreseeable future. The top band of the channel reflects a robust uptrend, while the bottom band serves as a support level for potential pullbacks. The Keltner bands confirm this upward trend, with a touch at 0.54633016 in the top band and a touch at 0.42842845 in the lower band. These indicators suggest a promising outlook for AGIX.

The emergence of verdant candlesticks coupled with an ascending price trajectory towards the upper band corroborates the persistence of the bullish trend. This maneuver signifies that purchasers are applying an upward force on the value and could potentially target the subsequent resistance level near the apex band.

According to the Money Flow Index (MFI), the asset is experiencing an influx of funds as its MFI currently stands at 66.26, surpassing the 50 thresholds. This positive trend is further reinforced by the divergence between the MFI and price, indicating the potential for upward momentum.

As the True Strength Index (TSI) maintains a positive trajectory above its signal line at -1.0490, the outlook for AGIX remains bullish. This presents a clear window for traders to consider a strategic entry point with the potential for continued growth.

In addition to the optimistic outlook, the Rate of Change (ROC) is in our favor, boasting a value of 5.22. This suggests that the stock’s momentum is gaining traction, further bolstering the potential buying opportunity for traders seeking to capitalize on AGIX’s upward trajectory.

According to the Relative Strength Index, AGIX is currently in a neutral zone with a reading of 53.80 above its signal line. This suggests the stock may experience some volatility shortly before continuing its upward trend. While the bulls still have the potential to push the price higher, it’s important to exercise caution as the RSI has not yet reached the overbought zone, leaving room for a possible retreat.

AGIX is positioned for a promising upswing as investors demonstrate unwavering faith in its prospects, bolstered by robust momentum and determined support levels.

disclaimer