- 149,999 ETH transferred to Coinbase worth $261,949,642.

- Traders advised to exercise caution and consider potential risks.

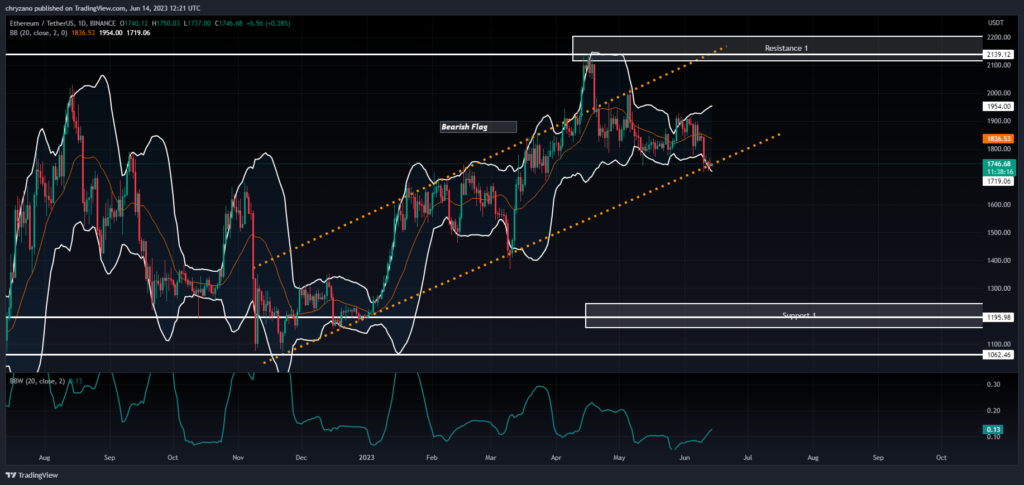

- Ethereum ensconced in a bearish flag, anticipating an imminent breakout.

Crypto Tony, a seasoned trader, and astute analyst, recently shared a tweet from Whale Alerts, a highly regarded blockchain transaction surveyor. The tweet revealed that a staggering 149,999 ETH had been transferred from an undisclosed wallet to Coinbase, amounting to $261,949,642. As a professional in the field, Tony recognizes the significance of such transactions and their potential impact on the market.

The rationale behind this extensive transaction remains unknown, leaving room for speculation. The whale is likely preparing to swap ETH for an alternative cryptocurrency or perhaps has a strategic move in mind. As a result, traders are advised to exercise caution and consider potential risks.

The chart above shows that Ethereum has been ensconced in a bearish flag since the latter part of November 2022. ETH has predominantly grazed the upper trend line throughout its tenure within the flag. Over nearly half a year, Ethereum has consistently achieved higher highs and higher lows. Consequently, it is reasonable to anticipate an imminent breakout from the flag.

When trading the bearish flag, adhering to best practices is key. To maximize profits, it’s recommended to set the take profit of your short position just below the Support 1 level. This strategy is rooted in the tried-and-true technique of adjusting the wedge height during the early stages of formation, ultimately leading to a successful breakout. By following these guidelines, you can approach your trades with confidence and professionalism.

In addition, a prudent approach would be to position the stop loss at the uppermost trend line of the wedge, allowing for ample room for Ethereum to experience fluctuations. In the event of a potential wedge breakdown, it is plausible for Ethereum to plummet to $1062.

When analyzing the optimal timing for a breakout, the Bollinger bands present a potential obstacle for ETH’s current wedge pattern. The lower Bollinger Band has been touched despite the possibility of a breakout, indicating a potential retracement and subsequent rise. This suggests that ETH may fluctuate within the wedge for an extended period. Additionally, the Bollinger bandwidth indicator is rising, potentially widening the bands and heightened volatility. As such, careful consideration and analysis are necessary to navigate this complex market.

Therefore, it is imperative for traders to strategically time the market strategically, specifically pinpointing the breakout point from the wedge. It is highly recommended that they utilize a precise blend of indicators to assess market behavior accurately.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.