Blur, the innovative digital art startup, has become the go-to NFT marketplace for seasoned traders. The platform’s remarkable trading volume figures testify to its success, surpassing industry giant Opensea in daily trading volume. This impressive feat has been maintained for over a month, solidifying Blur’s position as a leader in the NFT market.

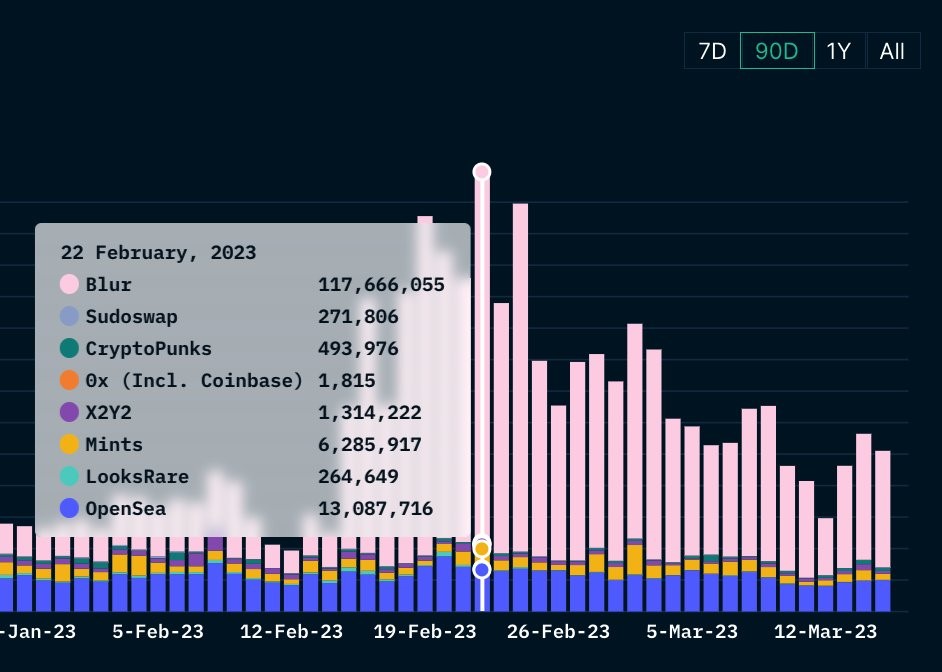

As per the data collated by Nansen, a reputable on-chain analytics firm, Blur’s daily trading volume reached an impressive $117.7 million on February 22. In comparison, OpenSea’s volume was a little over $13 million, indicating that Blur’s volume was approximately nine times higher than that of OpenSea. These figures highlight the significant market demand for Blur and its potential for growth in the future.

Nansen thoroughly analyzed the top ten most traded NFT collections on both Blur and OpenSea. The results revealed that the Mutant Ape Yacht Club emerged as Blur’s most traded NFT collection, boasting an impressive trading volume of 230,226 ETH. Meanwhile, Yuga Labs’ flagship NFT line, the Bored Ape Yacht Club, dominated the OpenSea platform with a staggering trading volume of 697,154 ETH. These findings provide valuable insights into the current state of the NFT market and highlight the popularity of these two highly sought-after collections.

According to the trading volume data, Blur has accomplished an impressive feat by capturing 46% of OpenSea’s volume in under five months, despite being a relatively new NFT marketplace. It’s worth noting that the data compiled by Nansen meticulously filtered out wash trades to calculate the trading volumes of both platforms accurately. This achievement speaks volumes about Blur’s potential and underscores its growing prominence in NFT.

Despite the impressive strides made by Blur in terms of trading volume and market share, its native token BLUR has failed to keep pace. Even on the day of the NFT marketplace’s highest daily trading volume, BLUR could only fetch a modest $1.08. Unfortunately, the token has since experienced a significant decline, losing over 44% of its value and currently trading at a mere $0.60. There is much work to be done to ensure that BLUR’s performance aligns with the growth of its parent company.