- Crypto trading volume surpassed $1 trillion in December 2023.

- Binance led December’s volume with a 39.3% share.

- Spot bitcoin ETF anticipation fueled December’s market activity surge.

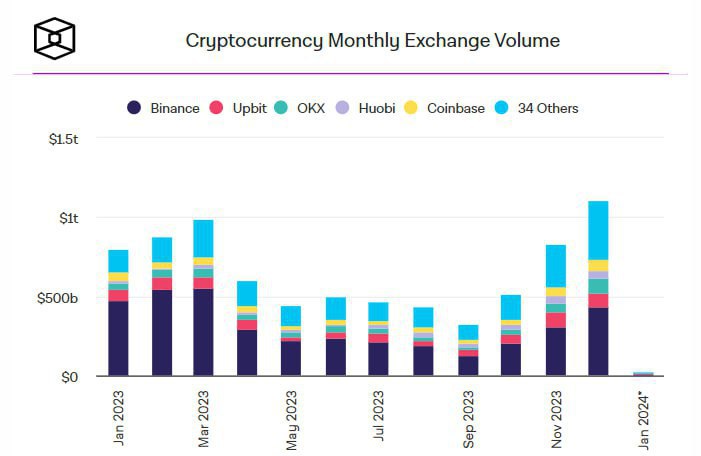

In December 2023, the worldwide market for cryptocurrencies experienced a notable achievement. According to the data, for the first time since September 2022, the trading volume for the month exceeded $1 trillion.

The data from The Block covers the period between January 2023 and January 2024, encompassing prominent crypto exchanges like Binance, UPbit, OKX, Huobi, and Coinbase, as well as a group labeled “34 Others.”

Information from The Block’s Data Dashboard indicates that the trading volume for December hit $1.1 trillion, exceeding the prior record established in September 2022, which was $1.03 trillion.

The statistics indicate that in December, Binance was at the forefront, representing 39.3% of the total monthly volume, which equaled $432.7 billion. UPbit and OKX were next in line, contributing 8.3% ($91.8 billion) and 8% ($87.5 billion) to the volume, respectively.

The industry’s collective hope for the potential greenlighting of spot bitcoin exchange-traded funds (ETFs) was credited with causing the unforeseen increase in crypto trading activity in December.

Steven Zheng, who serves as the Research Director at The Block, observes that December, which is typically a less active month for cryptocurrency transactions, experienced an unusual level of excitement. This suggests that there was an expectation for the approval of a spot bitcoin ETF and a return to a bullish trend in the market. Additionally, the growing expectation for the approval of Bitcoin ETFs contributed to the increase in Bitcoin’s value, pushing it to exceed $45,000.

Nevertheless, a new report from Matrixport, coupled with an increase in liquidations, led to a drop in Bitcoin’s value to $42,000. Information from CoinMarketCap indicates that there was a 64.43% increase in the worldwide cryptocurrency trading volume over the past 24 hours, reaching $118.36 billion.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.