- Ethereum achieves new milestone with mean block size reaching 1-month high.

- Surge in block size signifies rise in data volume, enhancing network capacity.

- ETH’s recent surge has propelled its weekly performance to +1.73%.

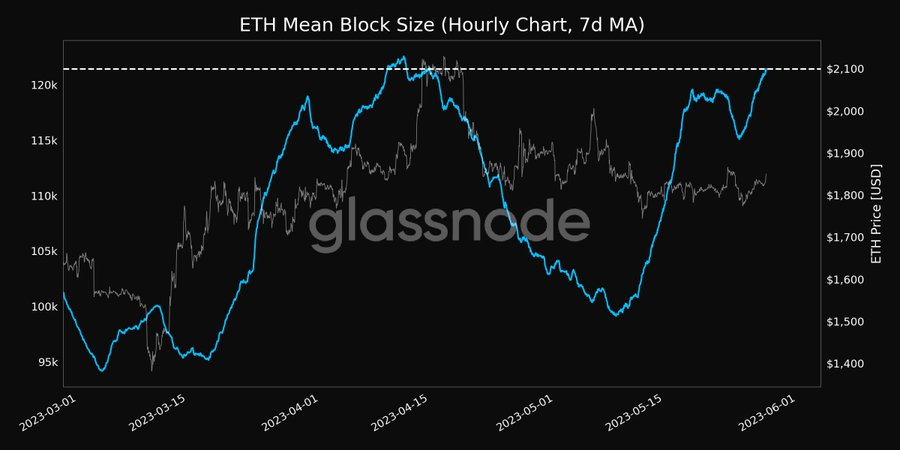

According to Glassnode, a leading on-chain analysis platform, Ethereum (ETH) has achieved a new milestone, with its mean block size reaching a 1-month high of 121,439.928. This impressive figure surpasses the previous record of 121,327.386, recorded on 27 May 2023. These statistics demonstrate the continued growth and development of the Ethereum network, highlighting its potential as a leading player in the blockchain industry.

The block size is a crucial parameter that determines the quantity of data or transactions that can be accommodated in a single block of the blockchain. A surge in this parameter signifies a substantial rise in the average data volume of the latest blocks, which can enhance the network’s capacity and transaction throughput. This development is a significant stride towards optimizing the blockchain’s performance and efficiency.

At the time of publication, CoinMarketCap reports that ETH is exchanging at $1,847.37, reflecting a modest 0.96% uptick in value over the past 24 hours. This places ETH closer to its daily peak of $1,859.79 than its 24-hour low of $1,817.49.

Despite the impressive upward trend of the top altcoin, Ethereum (ETH), it has yet to surpass its formidable rival, Bitcoin (BTC). Currently, ETH is experiencing a slight dip of 0.93% against BTC. Nevertheless, ETH’s recent surge has propelled its weekly performance to a commendable +1.73% in the green.

Over the last 48 hours, ETH’s value has impressively transformed the resistance levels of $1,816.5 and $1,842.6 into solid support. The leading altcoin’s price remains steadfastly above the crucial $1,842.6 threshold.

According to the RSI indicator on the 4-hour chart, ETH’s price may dip below the crucial level within the next 24 hours. The RSI line slows downwards towards the oversold territory, indicating a potential drop. Additionally, the RSI line is on the cusp of crossing below the RSI SMA line. These indicators suggest that caution may be warranted for those invested in ETH.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.