- Ethereum PoS network hits yearly low in active validators on January 12th.

- SEC’s pending decision on Ethereum ETF expected by May amid market uncertainty.

- Ethereum’s price at $2527, facing minor pullback with potential for recovery.

Statistics from Glassnode indicate that the Ethereum Proof-of-Stake (PoS) network experienced its lowest number of active validators for the year on January 12th. The decrease began on January 4th, which aligns with an unprecedented number of 17,821 validators choosing to exit the network’s pool of validators.

The day following the announcement by prominent cryptocurrency investment company Matrixport, which suggested that the U.S. Securities and Exchange Commission (SEC) might disapprove all Bitcoin ETF applications, this trend became apparent. The SEC still has to decide regarding the Ethereum ETF, with a decision expected by May.

Consolidation Phase

The current price of Ethereum is undergoing a correction, with indications that not only might a rally be approaching, but it may also be persisting. The asset has significantly declined recently, clearly visible on short-term charts.

During an extended stabilization period, numerous cryptocurrency experts have forecasted that Ethereum

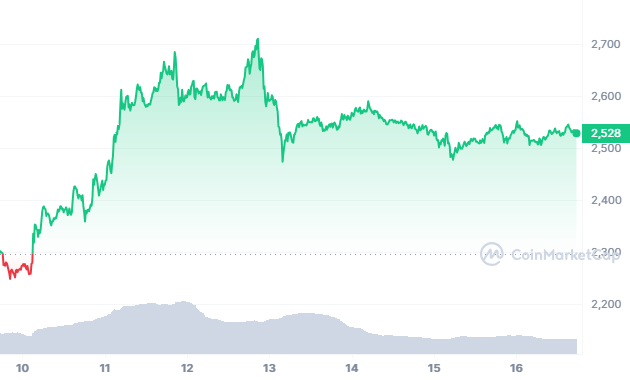

According to CoinMarketCap data, Ethereum’s trading price is $2527, representing a decrease of 0.46% over the past 24 hours. Additionally, there has been a 13.23% reduction in trading volume. Following an unsuccessful effort to surpass the $2711 level, the price has been experiencing a period of stabilization and a minor pullback.

Should the price surpass the $2591 mark, it is expected to continue its ascent towards the $2632 resistance mark. Conversely, should the price fall beneath the $2465 threshold, it is anticipated to continue its descent towards the $2358 support mark.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.