- Ethereum (ETH) price rises, trading volume increases, indicating strong buying activity.

- Large-scale investors acquire 410,000 ETH units, wallets with 1-10M ETH grow.

- Bitcoin surpasses $47,000 amid expectations of SEC’s approval of a Bitcoin ETF.

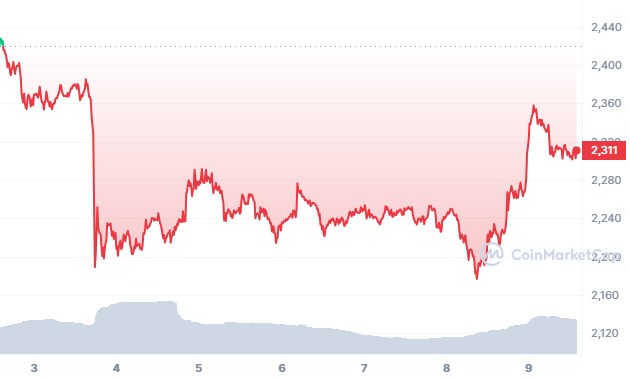

The cost of Ethereum

The increase in buying activity, as indicated by the rise in trading volume, bolsters the chances for significant price movements, which is evident from the recent uptick in prices.

Ethereum (ETH) experienced increases similar to other digital currencies as the cryptocurrency market recently entered a phase of positive momentum. Investors are optimistic that this upward trend will persist.

In the last thirty days, large-scale investors have acquired 410,000 units of Ethereum, with a total value exceeding $1 billion. Wallets holding between one million and ten million units of Ethereum have experienced a steady rise in their balances since early December of the previous year.

Anticipate Elevated Market Turbulence Soon

According to CoinMarketCap data, ETH’s trading price is $2298, reflecting a 2.54% increase over the past 24 hours. Additionally, there has been a 43.31% increase in trading volume. Previously, the price experienced extended downward pressure but eventually established support at the $2177 level.

The rally began anew from this point, surging to the $2359 mark. Should the price succeed in surpassing this mark, it is anticipated to continue its ascent towards the $2436 resistance mark. Conversely, should the price fall beneath the $2177 mark, it is expected to continue its descent towards the $2126 support mark.

Since April 2022, Bitcoin

Analysts at Bloomberg Intelligence have forecasted a 95% probability that approval will occur this week, which has increased market anticipation. As the U.S. Securities and Exchange Commission’s decision is anticipated to change the cryptocurrency environment significantly, investors and traders are expected to experience substantial volatility this week while closely monitoring the outcome.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.