- Analyst Wolf compares Ethereum’s current pattern to 2019’s pre-halving ascending triangle.

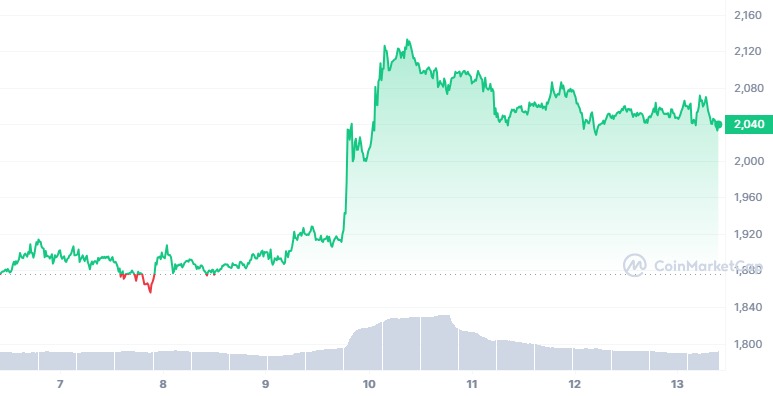

- Ethereum’s price surged from $1,911 to $2,130 before stabilizing between $2,040-$2,080.

- ETH faces resistance at $3,500; surpassing it could target a $4,320 price.

The cryptocurrency analyst and trader, known by the alias Wolf, expressed doubts regarding his audience’s understanding of Ethereum’s future direction. To address this, he provided educational content by posting a chart from 2019 and juxtaposing it with Ethereum’s

The analysis indicates that in 2019, the year preceding the Bitcoin halving, Ethereum’s price chart exhibited an ascending triangle pattern, followed by a significant price surge. Presently, a similar ascending triangle pattern is observable. Given that we are approaching the year before the upcoming Bitcoin halving in 2024, Wolf likely anticipates a potential increase in Ethereum’s value.

The chart indicates that at the opening of the trading week, ETH was priced at $1,876. The cryptocurrency exhibited minimal volatility for the initial three days, oscillating between $1,880 and $1,920. However, on the week’s fourth day, a surge in buying activity propelled ETH’s value from $1,911 to a peak of $2,130. Subsequently, ETH experienced a decline in its upward trajectory, with its price ranging between $2,040 and $2,080.

The chart indicates a pattern of ascending lows for ETH, with its peak prices remaining stable, forming an ascending triangle configuration. This pattern suggests that sellers have consistently countered buyers’ attempts to increase prices. However, should ETH exit this pattern to the upside, it will likely approach the vicinity of $3,200. It is important to note that ETH faces significant resistance at approximately $3,500, which it may attempt to challenge. Surpassing this resistance level could potentially lead to ETH achieving a price point of $4,320.

Nonetheless, ETH has reached the upper boundary of the Bollinger Bands, indicating a potential pullback. Consequently, ETH may experience a corrective bounce from the lower trendline or potentially from the support level at $1,540.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.