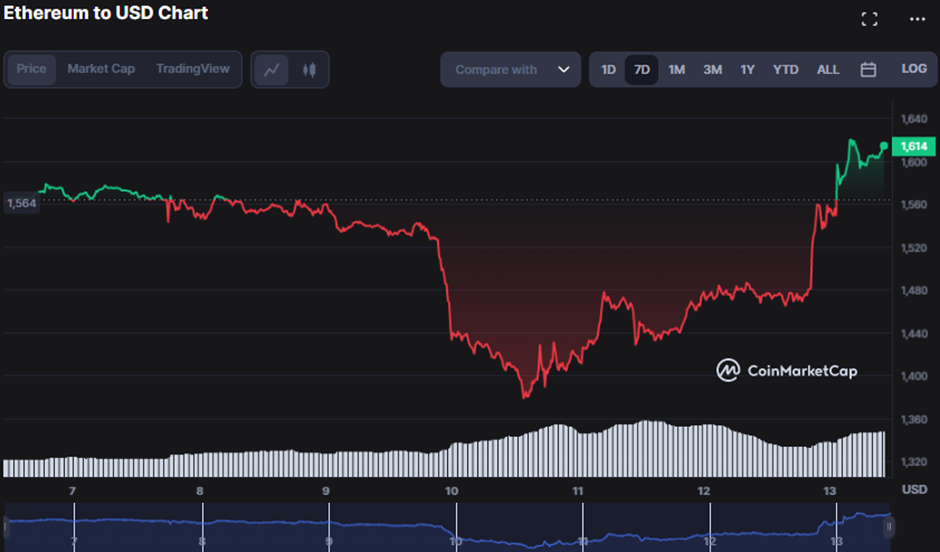

Following a week of bearish pressure, Ethereum (ETH) bulls have made a strong comeback at the start of the new week. Opening the day at $1,461.61, ETH has surged to a new weekly high of $1,629.37 in the last 24 hours, indicating a bullish awakening. At present, bullish dominance prevails, driving the ETH price up by 10.24% from its daily low of $1,616.40.

As the uptrend gained momentum, savvy traders eagerly joined the rally, resulting in a remarkable 10.20% surge in market capitalization. The final figure now stands at an impressive $197,930,549,830, a testament to the power of strategic investment and market insight.

The surge in ETH’s value and market capitalization is a promising development for the cryptocurrency market, signaling a bullish sentiment among investors. The 24-hour trading volume has also witnessed a notable uptick of 24.22%, reaching a staggering $13,224,107,963. This surge in activity and interest in ETH trading could pave the way for further market expansion and price appreciation.

On the 2-hour price chart, a promising development has emerged as the 20-day moving average has intersected the 100-day moving average, creating a coveted “golden cross.” This technical indicator could potentially entice more buyers to enter the market, leading to a surge in ETH’s value shortly.

The convergence of the 20-day MA at 1531.83 and the 100-day MA at 1524.23 has formed a bullish crossing known as the golden cross. This technical analysis suggests a potential upswing in the market, presenting a clear window for investors to consider buying.

According to the Relative Strength Index (RSI) of 72.17, the current bullish trend in ETH is deemed overbought, potentially leading to a correction shortly. However, it’s important to note that an overbought status doesn’t necessarily equate to a sell signal, and it could signify a robust momentum and a continued upward trajectory in the price of ETH. As always, exercising caution and carefully monitoring market trends before making any investment decisions is crucial.

According to the Money Flow Index (MFI), the current reading of 74.62 on the ETH price chart signals a robust bullish momentum. The purchasing pressure is steadily increasing, indicating a high probability of the uptrend continuing shortly.

Furthermore, the Aroon up boasts an impressive 71.43%, while the Aroon down lags at 28.57%. This suggests that the bullish momentum is still strong, and traders may want to consider opening long positions to take advantage of the current upward trend. This notion is reinforced by the MFI trend, making it a sound strategy for those seeking to capitalize on the market’s recent upswing.

Despite the current stochastic RSI reading of 65.64, which indicates an overbought market, the movement below its signal line suggests an imminent correction. As a precautionary measure, traders should consider placing stop-loss orders to mitigate potential risks in a sudden downturn.

The ETH market has witnessed a resurgence of bullish sentiment, with a significant price surge and the formation of a golden cross. However, prudent investors are advised to exercise caution, as overbought indicators indicate a potential correction shortly. It is essential to remain vigilant and make informed decisions based on market analysis and risk management strategies.