The Ethereum community is abuzz with excitement over the highly anticipated Shanghai Upgrade. However, the increased attention also brings with it a heightened level of scrutiny that could potentially jeopardize the future of ETH. The founder of Cobo has warned that private keys associated with staked ETH addresses may be at risk of exposure. We must remain vigilant and take all necessary precautions to safeguard the security and integrity of the Ethereum network.

Shenyu, the visionary behind Cobo, a leading digital asset custody service provider, has raised a red flag regarding the security of private keys for Ethereum addresses that have staked their ETH. This development has understandably caused concern within the community, and proactive measures may be necessary to safeguard against any potential fallout.

To safeguard against the potential threat of private key exposure, the esteemed founder of Cobo has advised centralized staking providers to thoroughly evaluate their private key storage methods, assess the status of authorized personnel, and establish contingency plans. By taking these proactive measures, we can effectively mitigate the risk of any potential damage to the Ethereum community.

Furthermore, Shenyu has wisely cautioned against potential risks by drawing attention to a previous incident during the launch of Arbitrum’s AirDrop, where numerous private keys were inadvertently exposed. This serves as a poignant reminder of the criticality of implementing proactive measures to protect private keys and mitigate potential harm to the Ethereum community. We must remain vigilant and prioritize the security of our digital assets.

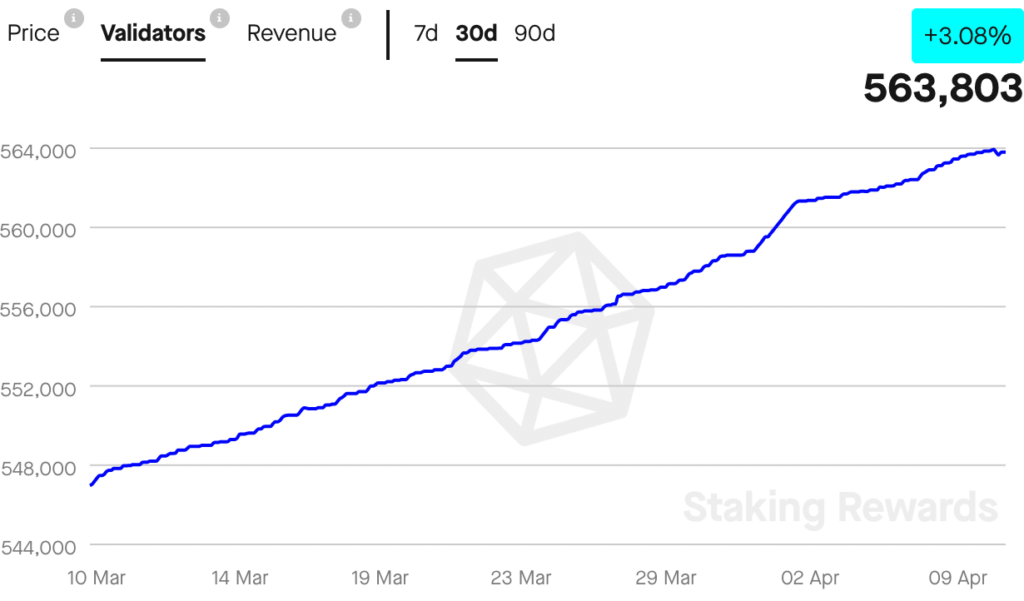

Despite the mounting apprehensions, validators on the Ethereum network remain steadfast in their support for the forthcoming upgrade. Recent data from Staking Rewards reveals a notable uptick of 3.08% in the number of validators on the network over the past 30 days.

Currently, the Ethereum network boasts an impressive 563,803 validators, collectively earning a staggering $2.34 billion in revenue. This remarkable achievement is a testament to the unwavering confidence that the community has in the future of Ethereum, even in the face of potential risks posed by the Shanghai Upgrade.

Furthermore, traders are exhibiting a favorable outlook towards ETH, potentially attributed to the decline in implied volatility (IV) of Ethereum options. As per Greeks Live, the IV for Ethereum has witnessed an 8% reduction in the last fortnight. A dip in IV for Ethereum implies that the market perceives the price of Ethereum as less hazardous and ambiguous.