The EUL token price of Euler Finance underwent a significant drop of 26.2% following an assault on its lending protocol. The crypto community was aware of the attack by BlockSec, a reputable firm conducting smart contract audits. The project incurred a loss of $177 million through four transactions, which took place a year after a funding round that included prominent players such as Coinbase, Jump, and the now-defunct crypto exchange FTX.

BlockSec, a reputable smart contract auditing firm, has warned crypto market participants about a recent attack. Initially suspected to be a theft of $8 million, further analysis has revealed a staggering loss of $177 million through four transactions. This unfortunate incident serves as a reminder of the importance of thorough security measures in the ever-evolving world of cryptocurrency.

In 2022, Euler Finance made waves in the financial industry by securing funding from prominent players, including Coinbase, the now-defunct FTX exchange, Jump, Jane Street, and Uniswap. This noteworthy achievement garnered significant attention and solidified Euler Finance’s position as a serious contender in the market.

In September of 2022, IntoTheBlock unveiled a cutting-edge risk-monitoring dashboard for Euler Finance, addressing the ongoing need for effective risk management and early threat detection within the DeFi ecosystem. This innovative solution is poised to bolster the industry’s sustainability, safeguarding against potential pitfalls and ensuring a secure and prosperous future.

Following the recent assault on the lending protocol, the ERC-20 token experienced a sharp decline of 26.2%, plummeting from $6.14 to $4.44 within a few hours. Noted crypto specialist ZachXBT has expressed skepticism regarding the possibility of retrieving the stolen funds and has classified the attack as “blackhat.”

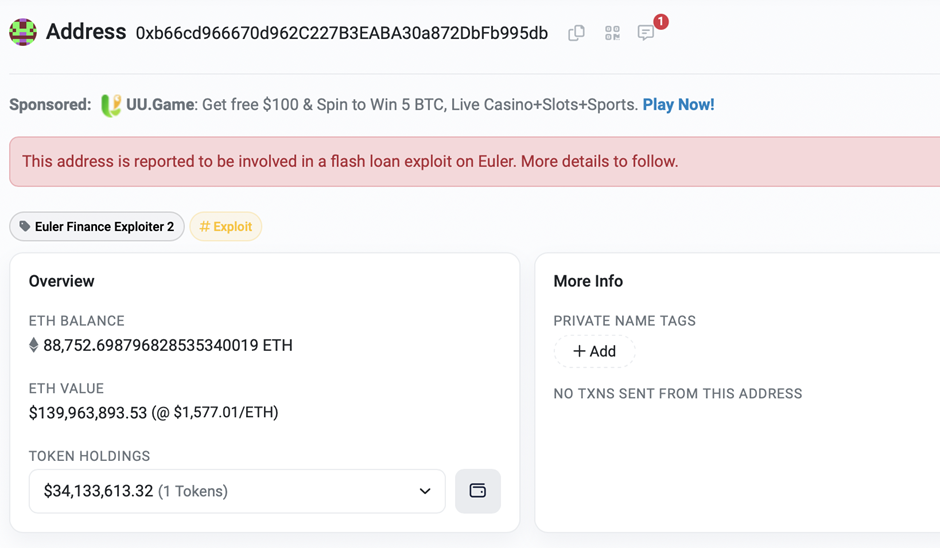

The skilled analyst has successfully established a connection between the assailant’s location and a prior breach of a protocol on the Binance Smart Chain. The perpetrator then transferred the ill-gotten gains into the Tornado mixer, posing a challenge for the Euler Finance crew. However, the team has taken swift action and is conducting a thorough investigation to ensure the safety and security of their valued users.