- Glassnode warns of potential high volatility for Bitcoin.

- BTC’s price range is the narrowest in three years.

- BTC’s recent decline is relatively minor compared to previous cycles.

Glassnode, the esteemed on-chain analysis platform, has taken to Twitter to share its latest findings on the crypto market leader, Bitcoin (BTC). According to their analysis, BTC’s price movements over the past week suggest that the crypto may be headed towards a period of high volatility. This insightful observation serves as a valuable warning to investors and traders alike.

As per the report, BTC has been confined within a 7-day price range that is the narrowest observed in the last three years. Glassnode further noted that this consolidation phase for BTC resembles the ones witnessed in January 2023 and July 2020.

The analytical platform has highlighted an interesting observation that deserves attention. Significant price movements have historically followed the consolidation phases experienced by BTC, and this finding may prompt traders to anticipate potential volatility shortly.

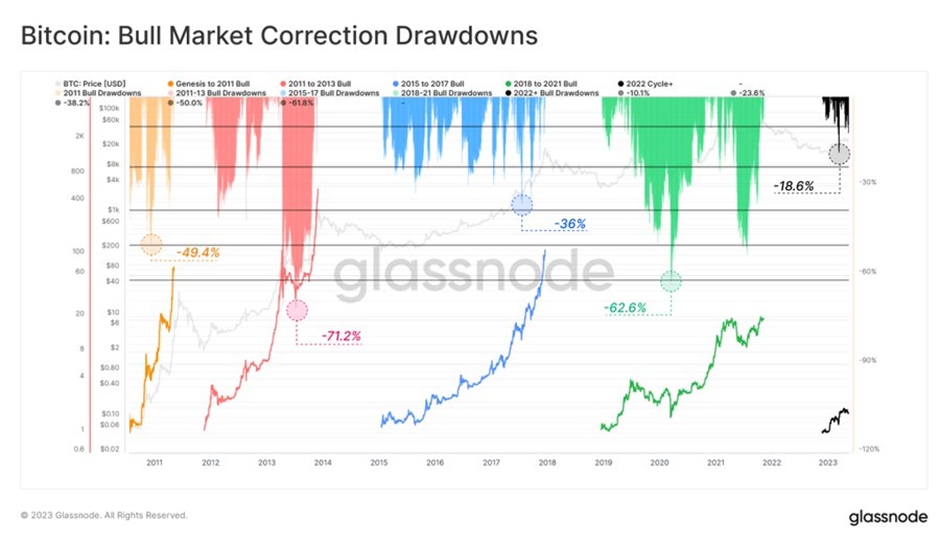

Despite potential turbulence for BTC, Glassnode noted in a separate Tweet that the extent of declines witnessed during BTC’s recent surge in value is relatively minor compared to previous cycles. The maximum decline during the bull market of 2011-2013 was a staggering -71.2%.

Furthermore, according to Glassnode’s data, the bull peak breakdowns of 2015-2017 and 2018-2021 were recorded at -36% and -62.6%, respectively. To provide context, the current bull peak breakdown 2022+ stands at a comparatively modest -18.6%.

According to CoinMarketCap, BTC is currently exchanging hands at $26,835.02. However, the past 24 hours have seen a slight dip of 0.90% in its price. Additionally, BTC has experienced a decline of over 2% in the past week of trading.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.