- Bitcoin whales increased their holdings in the second half of 2023.

- Bitcoin accumulation across all groups notably increased in October 2023.

- Bitcoin whales amassed over 30,000 BTC, equivalent to $1 billion.

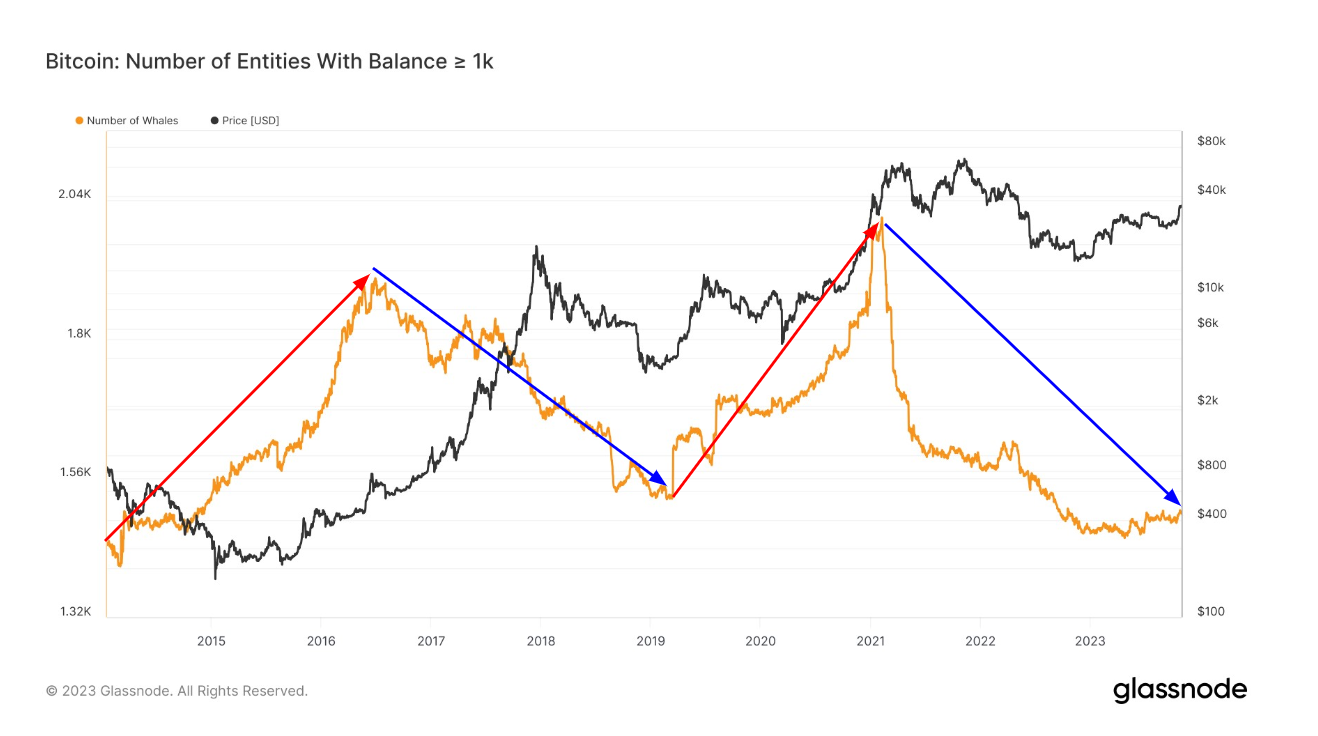

Crypto expert James Straten posted on Twitter earlier today, noting an increase in Bitcoin whales – those holding more than 1K BTC – in the second half of this year. He suggests that these whales are purchasing lower-priced BTC during bear markets to augment their holdings, with the intention of selling them for a profit during bull markets.

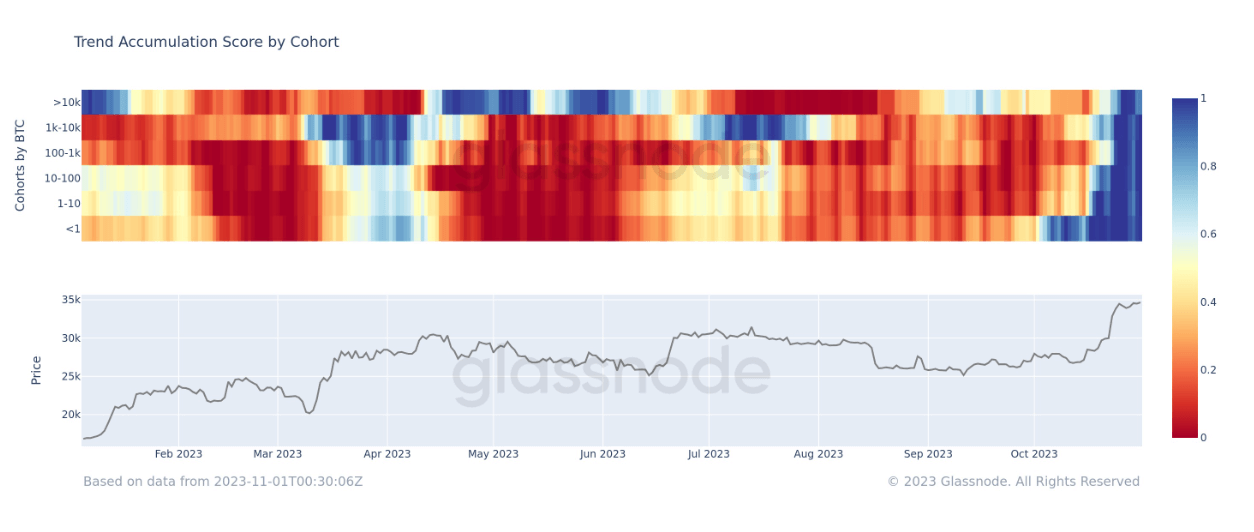

Cryptoslate data released on October 19 indicated a notable increase in Bitcoin accumulation across all groups in October 2023. Furthermore, the highest point of these holdings was observed in July, preceding Bitcoin’s rise from $30,000. This information underscores the substantial trust and participation of Bitcoin investors, irrespective of their holdings being less than one Bitcoin or exceeding 10,000 BTC.

Additionally, the study verified that there was a steady growth in the count of whales in 2023, escalating from 1,400 BTC to 1,500 BTC.

On October 31, a cryptocurrency enthusiast on Twitter reported that Bitcoin whales have amassed more than 30,000 BTC, equivalent to $1 billion, within a week. According to their assessment, this uptick is associated with heightened institutional attention spurred by the expected launch of Bitcoin ETFs. The market has demonstrated positive trends, with Bitcoin

Scott Johnsson, a financial lawyer based in the United States, ignited discussions yesterday about the possible sanctioning of a spot Bitcoin ETF by the US SEC on November 2. Furthermore, Johnsson’s post referred to a forthcoming private meeting set for the same date, noting, “I think this is the first private meeting of the Commissioners since the deadline for the Grayscale appeal passed, and the mandate was issued,” with a schedule that includes the settlement of litigation claims and administrative proceedings.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.