- Traders apprehensive about investing in larger dips over a longer period.

- Bitcoin’s price experienced a slight dip in the second week of March 2023.

- BTC’s price poised to decline further in the next 24 hours.

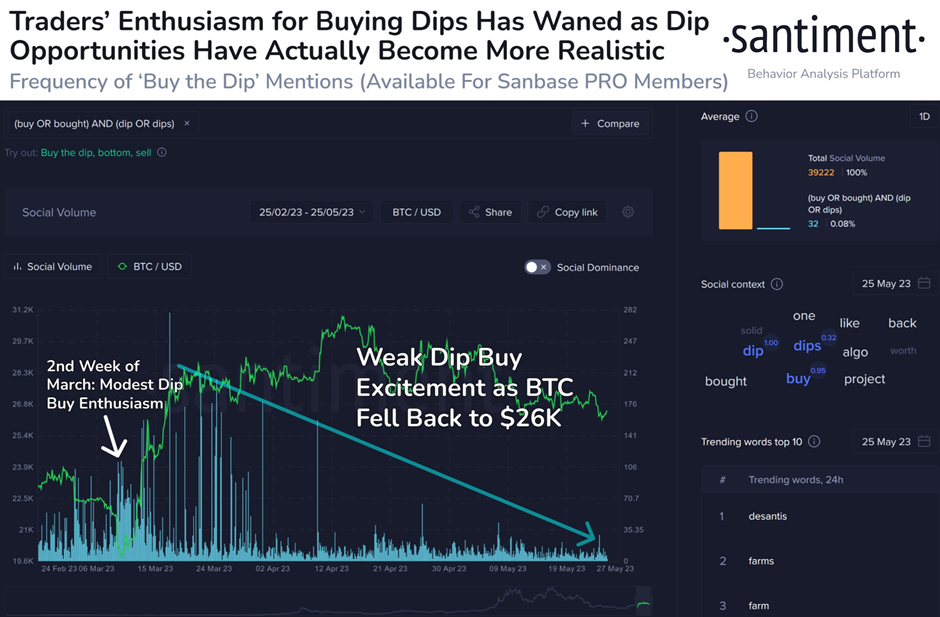

According to a recent tweet by Santiment, traders are facing a paradoxical situation where they are quick to buy small dips in BTC’s short-term price changes but are apprehensive about investing in larger dips over a longer period. However, the post also highlights that such periods of FUD have historically proven favorable opportunities for investors to make profitable gains.

According to Santiment’s data, the second week of March 2023 witnessed moderate trader enthusiasm as Bitcoin’s price experienced a slight dip. This starkly contrasts the recent market downturn, which saw the price of the leading cryptocurrency plummet below $26K, resulting in a notable lack of enthusiasm from traders and investors.

As of publication, CoinMarketCap reported that BTC’s value had surpassed the $26K threshold, reaching $26,355.06. This was a modest increase of 0.38% over the past 24 hours. Despite this encouraging development, BTC’s weekly performance remained red, with a decline of 1.97% over the last 7 days.

Over the past 24 hours, BTC’s price surpassed the 9 EMA line on its 4-hour chart, peaking at $26,611. However, it has since retreated below this crucial EMA line and is trading at press time.

According to the RSI indicator on BTC’s 4-hour chart, the price of BTC is poised to decline further in the next 24 hours. The RSI line slows downwards towards the oversold territory, indicating a bearish trend. Additionally, the RSI line is on the verge of crossing below the RSI SMA line, another negative technical signal. These indicators suggest that caution is advised for those considering investing in BTC.

Should BTC successfully close a 4-hour candle above the 9 EMA line by the end of today’s trading session, there is a promising chance for its price to soar to $26,700 shortly. Conversely, if it fails to do so, the likelihood of BTC’s price plummeting to $26,169 in the coming days is high. It’s a crucial moment for BTC, and investors and traders will closely monitor the outcome.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.