- Bitcoin analysts anticipate potential surge in market activity in June.

- Willy Woo emphasizes significance of scrutinizing Bitcoin’s cost basis.

- Analysts caution against oversimplifying market dynamics and relying on single signals.

Bitcoin aficionados are closely monitoring June for a potential surge in market activity, as per insights shared by analysts on Twitter. A prominent Bitcoin data analyst, Willy Woo, has pointed out that despite the typically subdued or bearish summer market trend, historical data suggests that June has consistently displayed a bullish bias during the re-accumulation phase. In a thought-provoking twist, analyst “Colin Talks Crypto” has raised questions about the reliability of a particular indicator.

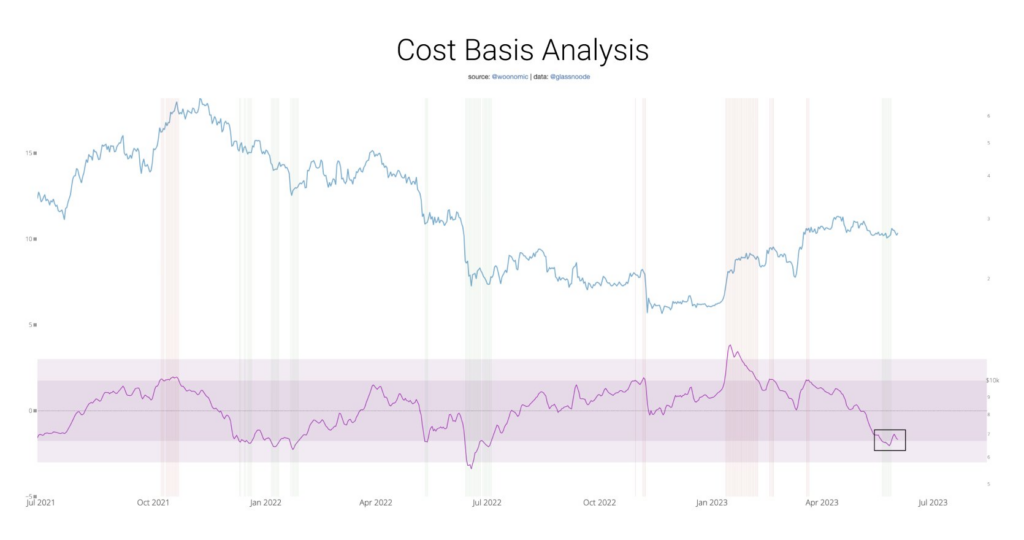

Willy Woo recently took to Twitter to emphasize the significance of scrutinizing Bitcoin’s cost basis for accurately predicting market movements. The purple indicator on the chart represents the pricing on a cost basis, and Woo stressed the importance of not oversimplifying market dynamics. He cautioned investors against relying solely on a single signal for making investment decisions. It’s crucial to approach the analysis with a professional and comprehensive mindset.

Building upon Woo’s elucidation, the areas shaded in a lighter shade of pink on the graph denote the zones of extremity where Bitcoin’s valuation has diverged considerably from its underlying cost basis. Nevertheless, these aberrations typically trigger a mean reversion trajectory towards the center, thereby presenting a promising prospect for market players.

According to the analyst, although the CBBI and its counterparts provide valuable insights, it is imperative to exercise prudence when interpreting their signals. Woo emphasized that these oscillators indicate an opportunity when the market reverts to its mean rather than during its movement towards extremes. This emphasis underscores the significance of understanding the bigger picture and utilizing a comprehensive approach to scrutinizing Bitcoin’s market dynamics.

As the Twitter dialogue between these astute analysts persists, market participants eagerly anticipate the projected “BTC rip window” in June. With historical data and cost basis analysis bolstering the potential for a bullish surge, Bitcoin aficionados and investors are watching the market.