- Cryptocurrency expert Michaël van de Poppe advises investing in altcoins now.

- Poppe highlights Chainlink’s progress on its Cross Chain Interoperability Protocol.

- Poppe suggests building altcoin portfolio through Dollar Cost Averaging approach.

In the realm of cryptocurrency trading, the element of timing is pivotal in shaping investment results and the performance of assets. Over numerous cycles, this temporal aspect has proven to be a key determinant in the expansion of altcoins and in pinpointing the optimal period for accruing these assets.

Given the recent fluctuations in the cryptocurrency market and the persistent instability of key cryptocurrencies such as Bitcoin

Intriguingly, renowned cryptocurrency expert Michaël van de Poppe offered his insights on the subject, specifically addressing the price trajectory of various altcoins. Poppe highlighted that numerous altcoins have experienced significant depreciation, ranging from 90% to 99%, from their all-time highs (ATH).

Poppe, the founder of MN Trading, expressed that there are other factors besides the current drawdown in deciding whether to invest in altcoins. He emphasized the importance of considering other crucial factors, such as the underlying fundamentals, past performance, and prevailing market sentiment.

Bitcoin’s Dominance to Steer the Way

Poppe elucidated that the internet search volume for alternative cryptocurrencies has substantially declined. However, examining the historical trends surrounding Bitcoin halvings indicates that alternative cryptocurrencies typically reach their lowest values about ten months before the halving event. In past cycles, Bitcoin has also seen a reduction in its market dominance, paving the way for a surge in alternative cryptocurrencies during this timeframe.

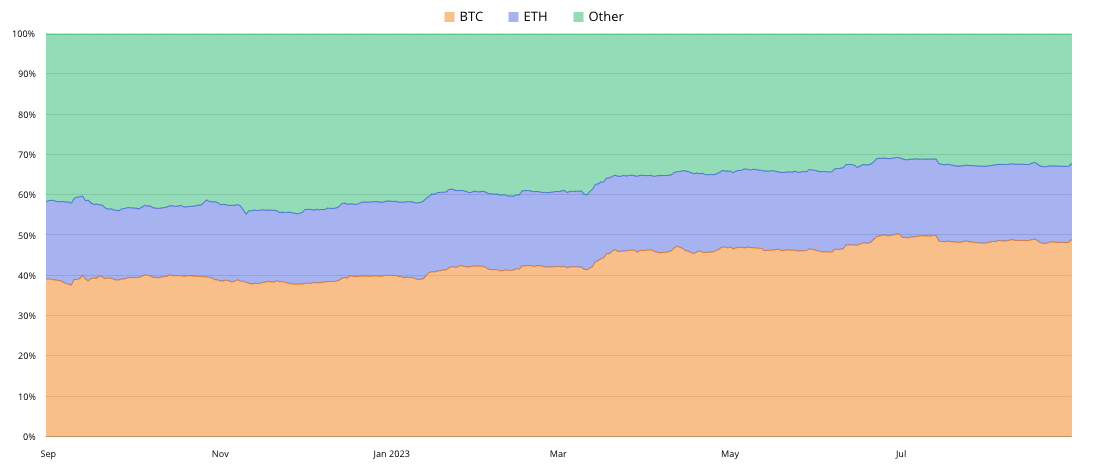

As we approach the onset of the altcoin season, Bitcoin’s dominance tends to diminish, creating a conducive environment for ETH and other altcoins to flourish. Nevertheless, data from BTCTools indicates that Bitcoin has sustained its supremacy over Ethereum, with a dominance ratio of 48.27% to 18.87%.

Additionally, it is typically advantageous to retain Bitcoin or Ethereum when their market dominance escalates. Conversely, a decline in dominance presents a prime opportunity to amass altcoins. The dominance has plateaued, potentially providing an optimal window to purchase altcoins at their prospective lowest points.

Beyond the supremacy graph, Poppe highlighted that advancements in altcoin projects should indicate accumulation. He cited the surge in DeFi and NFT transactions as compelling reasons to consider altcoin accumulation earnestly.

LINK With a High Probability

As in past instances, the analyst consistently highlighted Chainlink

To provide some background, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is a cross-chain communication mechanism that empowers smart contract developers with the capability to transfer data and tokens across various blockchain networks in a way that minimizes trust-related issues.

At the time of writing, the price of LINK stands at $6.06, marking a 2.96% rise in the last 24 hours. A glance at the LINK/USD 4-hour chart reveals that the token experienced a resistance at $6.24 following a swift ascent from $5.88. Despite this, the dip in LINK’s value does not appear to have impacted its accumulation.

The Chaikin Money Flow (CMF) stood at 0.04 when penning this. As a fundamental measure of accumulation and distribution, the CMF suggested that LINK was experiencing a bullish trend driven by heightened purchasing activity.

Should the CMF persist in its upward trajectory, it could signal a surge in LINK’s valuation, with price targets projected to fall within the $6.30 to $6.50 range.

Crypto expert Michaël van de Poppe has highlighted that the present market scenario allows investors to build their altcoin portfolio through the Dollar Cost Averaging (DCA) approach. Whether this strategy will yield profitable results remains to be seen with time.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.