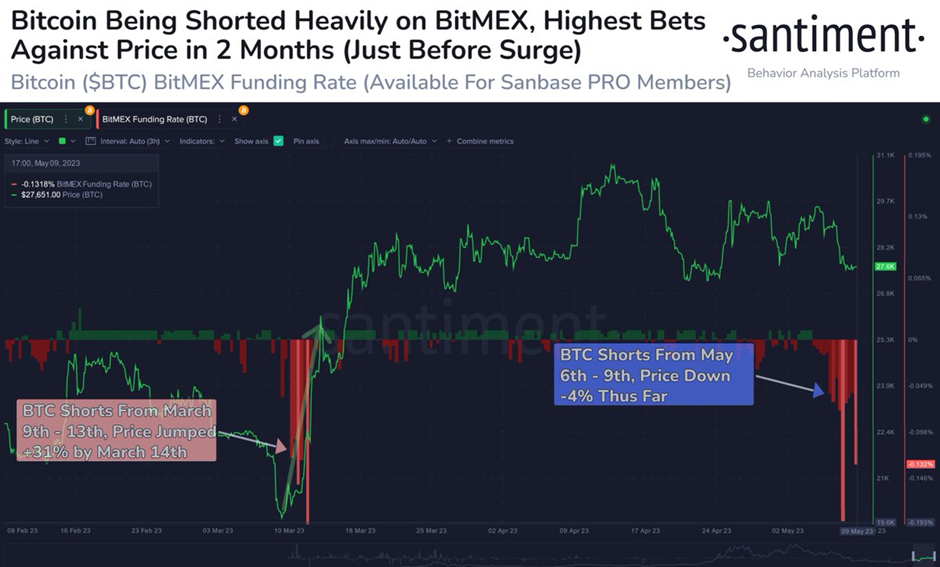

According to a recent tweet from Santiment, a leading blockchain intelligence firm, the funding rate for Bitcoin (BTC) on Bitmex has hit its lowest point since March of this year. This development has led the platform to predict a potential BTC price surge shortly. As always, we will monitor the market closely and provide updates as they become available.

Santiment’s analysis suggests that Bitcoin’s price rises when investors and traders anticipate a drop. While this theory remains untested, recent data shows that BTC’s value has decreased by roughly 4% between May 6th, 2023, and the present.

According to the latest update from CoinMarketCap, the top cryptocurrency registered a modest 0.27% increase in value in the last 24 hours, bringing its current price to $27,673.51. However, despite this encouraging development, BTC’s weekly performance remained red, with a 2.86% decline over the past 7 days.

According to the technical indicators on BTC’s daily chart, the cryptocurrency’s price is poised to experience a further decline within the next 24-48 hours. The formation of a descending triangle, resulting from BTC’s recent trend of printing lower highs over the past two weeks, indicates a significant amount of sell pressure currently on the market leader’s chart.

If BTC’s value yields to the current sell pressure, it will likely experience a short-term decline to $26,600. This pessimistic outlook is reinforced by the recent bearish cross observed between the 9-day EMA and 20-day EMA, indicating that BTC has entered a short-term downtrend.

BTC’s price must conclude below the critical $27,380 level to validate the bearish outlook. Conversely, if BTC manages to sustain its position above this level, it could lead to a temporary consolidation phase within the $27,380 to $28,420. Alternatively, a breakthrough above the 9-day and 20-day EMA lines, around $28,700, could be a bullish signal. As a professional, keeping a close eye on these levels is crucial to make informed investment decisions.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.