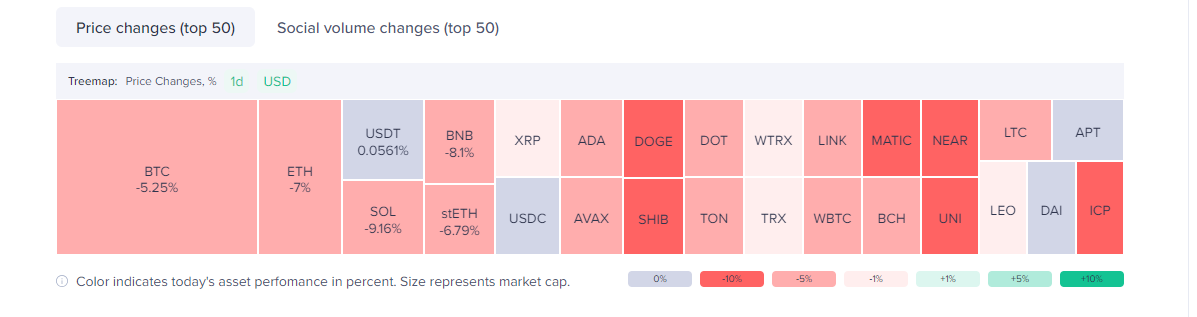

- Cryptocurrency market drops, Bitcoin falls to $64,650, a 6% decrease.

- Ethereum and altcoins see significant losses; Ethereum down 7.56% to $3,356.

- Despite market dip, Fantom slightly increases by 0.94% amidst widespread declines.

In a dramatic shift, the cryptocurrency market experienced a notable drop today, causing a stir among enthusiasts and investors. As the situation stabilizes, opinions among traders are divided, oscillating between fear and the prospect of investment, with some viewing the downturn as an opportunity to purchase at lower prices.

The market’s collective mood has deteriorated, evidenced by a substantial 6.4% decrease in the value of key cryptocurrencies. Nonetheless, trading activity has risen by 13%, indicating a spike in transactions as a reaction to the market fluctuations.

Bitcoin’s Fall

Bitcoin

The Downturn Affects Altcoins

Not only was Bitcoin affected by the downturn, but Ethereum

Solana Experiences Unexpected Decline

Solana

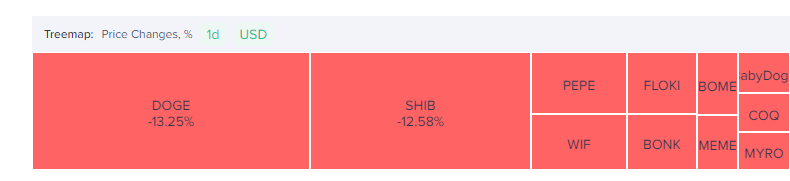

Memecoins Experience a Decline

The instability also affected memecoins that had experienced rapid expansion over the previous month. Nonetheless, the current market dip resulted in significant double-digit percentage losses for these coins, including WIF, which decreased 24%; BONK, which fell 22%; PEPE, which was also down 22%; FLOKI, which declined 20%; and DOGE, which reduced 13%.

Fantom’s Slight Increase Despite Market Turmoil

Amid widespread declines, Fantom stood out with a small increase of 0.94%, providing a faint sign of optimism for investors during the ongoing cryptocurrency market downturn.

As the cryptocurrency market experiences a downturn, the current situation underscores the market’s natural instability and uncertainty. Some view this downturn as a short-term difficulty, while others take advantage of the lower prices. The community is preparing for future developments, with everyone closely watching the market data, awaiting the subsequent development in the risky activity of trading cryptocurrencies.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.