- Bitcoin surpasses $64,000, highest since November 2021.

- Coinbase experiences system failure amid Bitcoin surge.

- Morgan Stanley considers Spot Bitcoin ETFs for brokerage service.

The dominant cryptocurrency, Bitcoin

The upward trend of BTC persisted, reaching a fresh high for the year at $64,058 on February 28, which represented a 12% increase in its price within a mere 10-hour span, starting from $57,213. In the current month, Bitcoin has experienced a remarkable 50% growth in value, primarily driven by investors’ enthusiasm in spot ETFs.

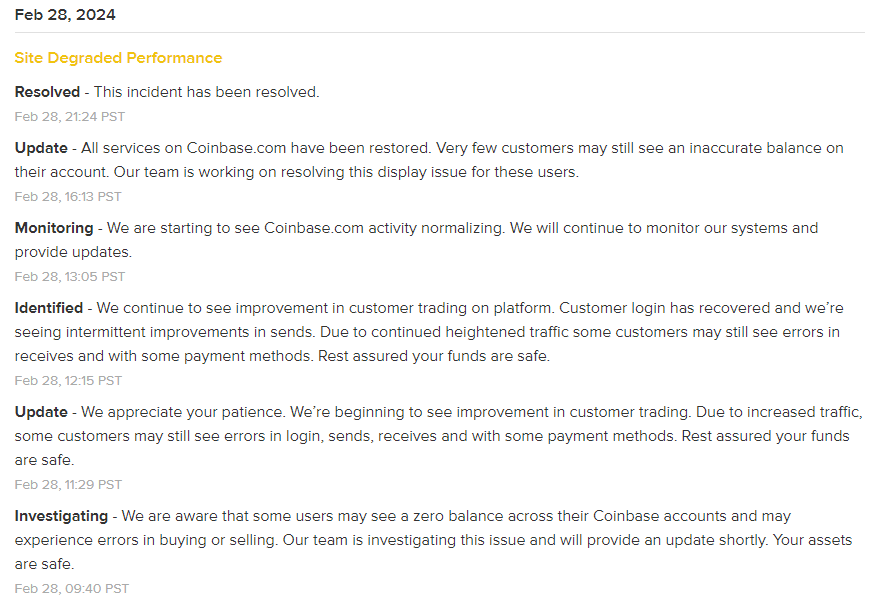

After the surge in Bitcoin value, Coinbase, a major cryptocurrency exchange, seems to have experienced a system failure, leading to alerts being sent to users and recognition of the problem. The platform’s status webpage shows that an investigation is currently underway, and there are reports from some users of seeing a balance of zero in their accounts.

What’s Behind the Recent Surge in Bitcoin (BTC)?

Bitcoin’s rise is being propelled by a combination of elements, such as the growing enthusiasm for Bitcoin ETFs and the excitement about the forthcoming halving event, which is predicted to happen on April 22, attracting more focus from those involved in the cryptocurrency sphere.

For three days in a row, the cumulative trading volume of Spot Bitcoin ETFs surpassed $7.5 billion. The Bitcoin ETF offered by BlackRock experienced a trading volume of $3.3 billion, which was twice as much as its prior record for volume.

Furthermore, the worldwide investment firm Morgan Stanley has indicated that it is contemplating the introduction of Spot Bitcoin ETFs on its brokerage service, which suggests a growing interest in cryptocurrency among institutional investors.

Despite the initial enthusiasm, Bitcoin abruptly declined in value, dropping to $59,7898 soon after hitting its highest point. Experts link this downturn to the selling activity at the $64,000 mark and the closure of over-leveraged bullish bets. However, Bitcoin has demonstrated robustness by regaining almost 5% of its depreciated value.

As of this writing, BTC’s trading price is $63,193, and its market capitalization stands at $1.22 trillion. The significant increase in the cryptocurrency’s value is highlighted by a 22% rise in price in the previous week and an impressive 170% increase over the last year. Furthermore, BTC’s daily trading volume has experienced a substantial increase of more than 124%, reaching $90 billion, indicating increased trading activity in the market.

Bitcoin is currently trading at just 10% less than its highest-ever value of $68,789, which has investors feeling hopeful about the chance of reaching a new peak soon. Nonetheless, should the trend take a downturn, Bitcoin could see its price supported at $61,116, and if it falls further, it might drop to $59,250 and then to $58,700, with the possibility of a bear trap on the horizon.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.