- Elizabeth Warren proposes crypto regulation with “Digital Asset Anti-Money Laundering Act.”

- Bitcoin price drops sharply, liquidating over $200 million in assets.

- Investors await US CPI data and FOMC meeting for rate decisions.

U.S. Senator Elizabeth Warren, who has consistently voiced opposition to the cryptocurrency industry, has recently proposed legislation aimed at increasing regulatory oversight of the sector.

The “Digital Asset Anti-Money Laundering Act of 2023” calls for the United States Financial Crimes Enforcement Network (FinCEN) to create guidelines for detecting and documenting suspicious activities involving anonymous digital currencies such as Bitcoin

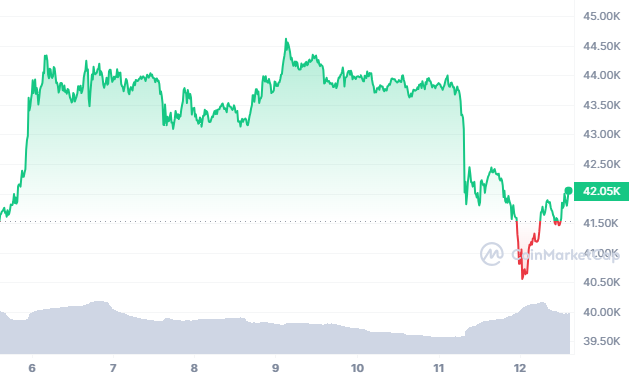

On the previous day, the value of Bitcoin experienced a sharp drop, falling from approximately $44,000 to roughly $40,550 because of an unexpected downturn that caused a rapid crash. This event led to liquidating assets exceeding $200 million, including $197 million from long positions and $8.23 million from short positions. Moreover, this downturn wiped out $1.2 billion in open interest.

High Volatility Ahead

Investors are preparing for the upcoming US CPI data release, which is expected to have a significant impact. If the latest CPI figures have an adverse effect, Bitcoin could hit $37,800, an important support threshold.

Market participants, such as traders and investors, are paying close attention to the Federal Open Market Committee (FOMC) meeting scheduled for December 13, 2023. There has been considerable conjecture regarding Fed Chair Jerome Powell’s forthcoming determination concerning the benchmark interest rate.

As of this writing, the trading price of Bitcoin stands at $42,038, which represents a decrease of 0.64% over the past 24 hours, according to CoinMarketCap’s data. Additionally, there has been a 23.55% increase in trading volume.

Should the price succeed in surpassing the $42,470 mark, it is expected to ascend and challenge the resistance at $43,770. Conversely, should the price fall beneath the $40,550 threshold, it is anticipated to descend and approach the support at $39,370.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.