- Bitcoin’s realized capitalization is 5.4% below its peak of $467 billion.

- Bitcoin recovery slower, possibly due to excess supply from trading strategies.

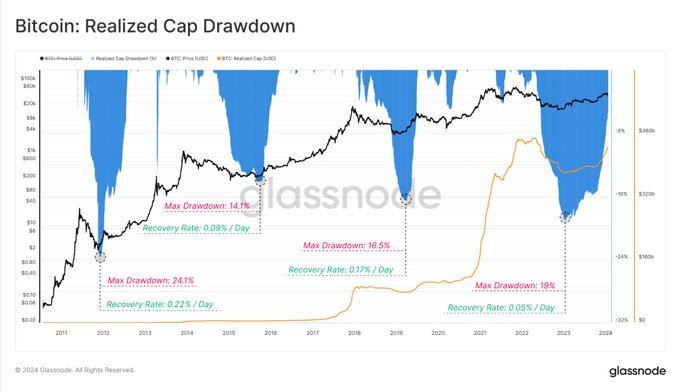

- Bitcoin’s realized cap growth rate declines in 2023-24 cycle to 0.05% daily.

Glassnode, a prominent platform for on-chain and financial data, reports that the realized capitalization of Bitcoin

In a new update on X, Glassnode described how the speed of Bitcoin’s current recovery has been noticeably slower than previous cycles. The service indicated that this might be due to the substantial excess supply resulting from difficult trading strategies, such as the Grayscale GBTC arbitrage.

Historical data from Glassnode indicates that during the market cycle of 2012-13, Bitcoin’s realized cap increased at a daily rate of 0.22%. For the 2015-16 cycle, this daily growth rate decreased to 0.09%. The rate experienced an uptick in the 2019-20 cycle, climbing to 0.17% per day. However, in the latest market cycle of 2023-24, the daily rate of Bitcoin’s realized cap has further declined to 0.05%.

It’s important to recognize that Bitcoin’s realized capitalization accurately represents the cryptocurrency’s true worth by considering the price at which each Bitcoin was most recently traded. In contrast to Bitcoin’s standard market capitalization, realized capitalization takes into account the historical transactions of Bitcoins, excluding those that have not been active.

The post by Glassnode includes a graph showing that Bitcoin’s realized capitalization is on a sharp upward trajectory. This pattern implies that the leading cryptocurrency is experiencing a bull market, as per the data on Glassnode’s site.

At the time of this report, Bitcoin’s trading price is $43,133, having recovered from a recent dip to $38,505, according to TradingView’s data. The leading digital currency remains valued over the crucial $40,000 mark, with holders anticipating an increase in BTC’s value in anticipation of the forthcoming Bitcoin halving event.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.