- Galaxy Digital CEO Mike Novogratz predicts SEC approval of a Bitcoin ETF.

- Grayscale court victory is key to the Bitcoin ETF’s approval.

- Bitcoin’s current price is $28,392, with a 21.20% reduction in trading volume.

The quest for a Spot Bitcoin ETF has been a central concern in the cryptocurrency industry throughout 2023. The market was surprised when traditional financial powerhouses disclosed their plans by submitting applications to the U.S. SEC.

Galaxy Digital Holdings’ Chief Executive Officer, Mike Novogratz, has projected that the U.S. Securities and Exchange Commission (SEC) will approve a Bitcoin ETF in the spot market within this year. During a conversation with CNBC, Novogratz conveyed his contentment with this prediction.

As highlighted by Novogratz, the victory of Grayscale in court against the agency is the most significant element influencing the impending approval. Furthermore, the decision regarding the interest rate is anticipated to be finalized on November 1st, hence, the focus of everyone is on this particular date.

Most market players predict that interest rates will remain stable. Nonetheless, declarations suggesting a potential rise in interest rates are causing some apprehension.

Positive Market Trend

As per the latest data from CoinMarketCap, Bitcoin is currently priced at $28,392, marking a 0.13% decrease in the past 24 hours. Additionally, there has been a 21.20% reduction in the trading volume.

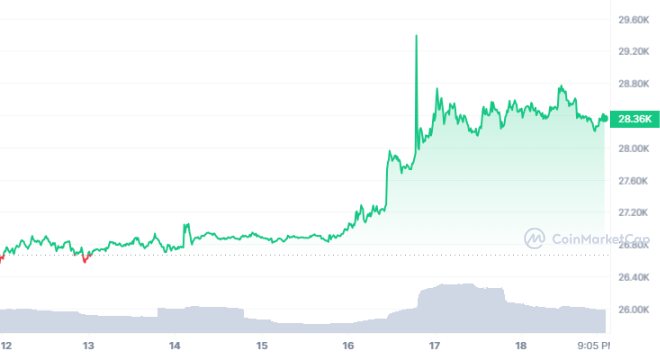

The positive trend started with the fake news of the approval of a spot Bitcoin ETF. The value surged up to the $29,400 level. However, when the facts came to light, the price fell back to $28,350. If the price surpasses the $28,730 level, it will likely challenge the recent peak of $29,400. It will aim for the $30,500 resistance zone if it breaks this level.

Nonetheless, should the price breach the support level of $27,700, it will probably move towards the $27,100 mark. Any additional decrease will lead to the price testing the $26,600 level.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.