- Bitcoin maintains value over $50,000; market depth increases by 19%.

- Spot Bitcoin ETFs launch; trading volume surges with significant transactions.

- Bitcoin spot ETFs see $135 million inflow; price hits $51,200.

Bitcoin

A crypto data provider named Kaiko has published a report indicating that since the onset of 2024, the market depth of Bitcoin has risen by 19%. In a statement released on X, Kaiko posed the question, “Has liquidity permanently returned?” Kaiko explains that market depth refers to the capacity of the market to absorb sizeable market orders without causing a significant price fluctuation for the asset.

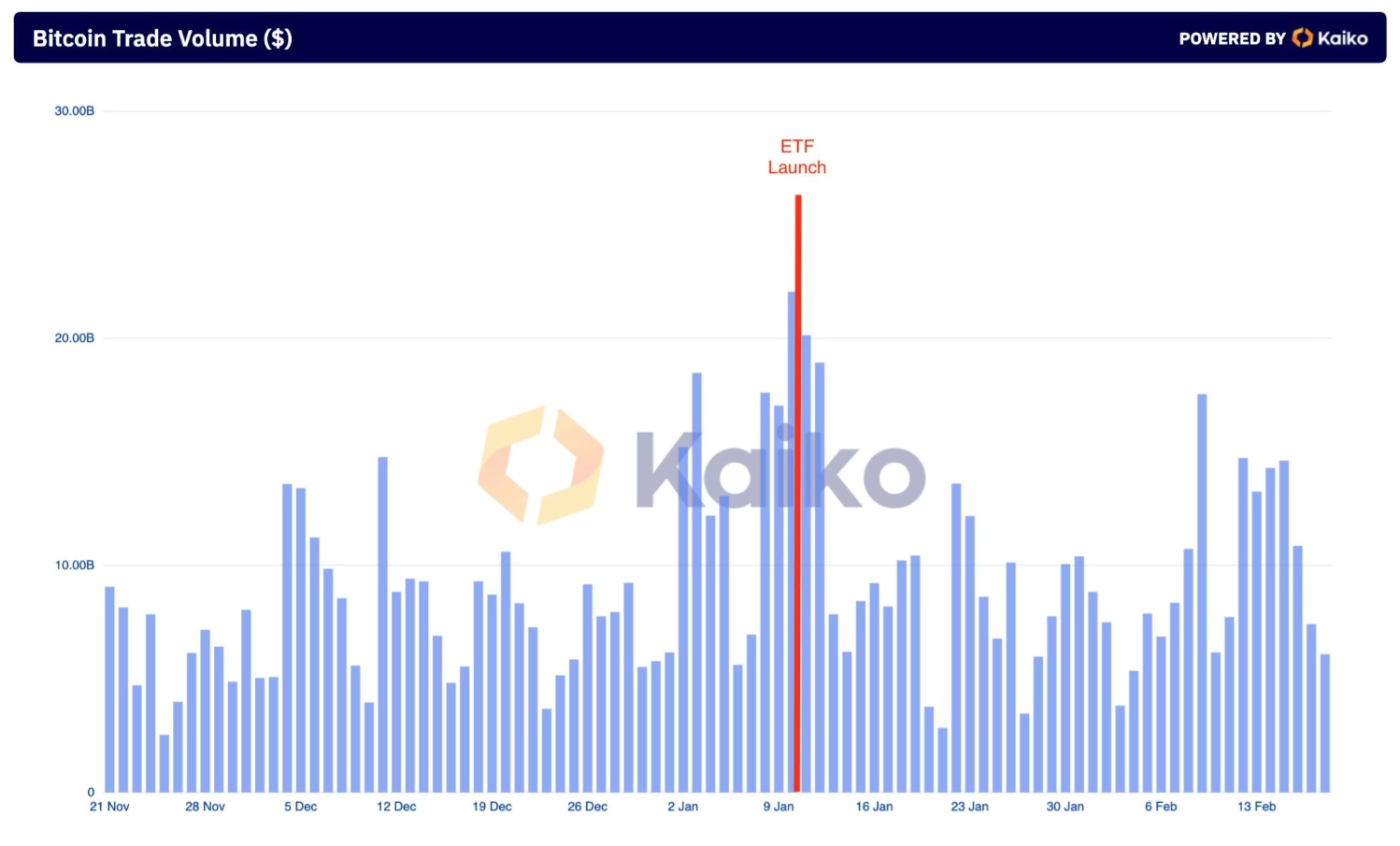

On February 19, the report that was disseminated displayed a rise in the trading volume of Bitcoin, as represented by a chart. This chart shows a significant increase in the volume of Bitcoin transactions coinciding with the initiation of trading for spot Bitcoin ETFs in the United States.

Furthermore, the information indicates that on February 13, the average transaction size for Bitcoin on 33 different exchanges peaked for the year, maintaining a value above $1,000 since the start of 2024.

The Web3 research platform SoSoValue recently reported that there was a net inflow of $135 million into Bitcoin spot ETFs on February 20. Previously, the largest single-day inflow recorded was $631 million, which occurred on February 13. Notably, on February 12, the value of Bitcoin exceeded $50,000.

Bitcoin’s trading price is $51,200, with a decrease of 1.6% observed over the past 24 hours. Despite this loss, there has been a 47% surge in trading volume during the same time frame, with the volume exceeding $32 billion.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.