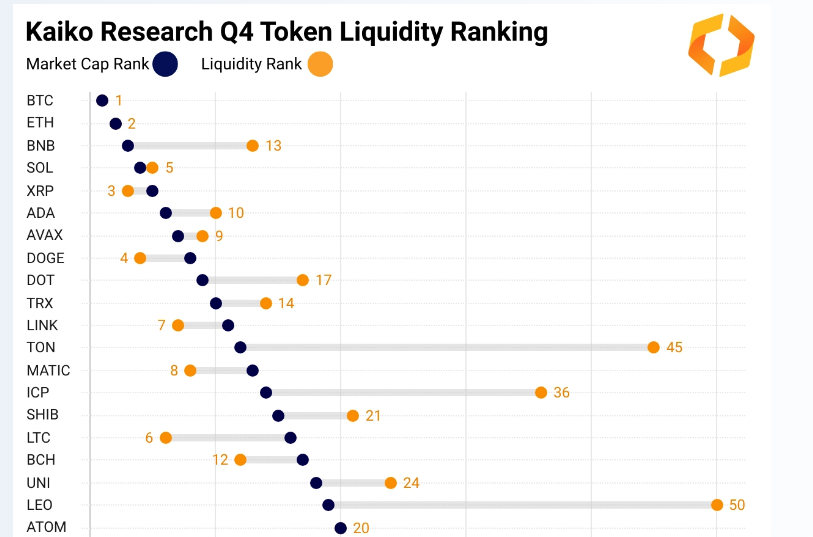

- Kaiko study ranks XRP higher in liquidity than BNB, SOL, ADA.

- Study challenges market cap focus, emphasizes liquidity for token value assessment.

- Bitcoin, Ethereum, XRP, Dogecoin remain top liquid assets; SOL overtakes LTC.

An analytical platform designed for institutions, Kaiko, has published a study that ranks XRP

The study assessed the liquidity measure for the 50 highest-ranked tokens during the final quarter of 2023. Kaiko challenged the traditional reliance on market capitalization as the main indicator and emphasized the significance of liquidity in properly determining a token’s real worth.

Points are allocated to tokens according to their market depth at 0.1% and 1%, the count of exchanges with liquidity, the breadth of their price spreads, and their trading volumes.

Kaiko initially observed that following a third-quarter characterized by the lowest trading volumes in several years, the fourth quarter saw a significant increase in trading activity. Bitcoin was the main focus due to the expected decision regarding spot ETFs. Concurrently, Solana saw an impressive value increase, from $23 at the beginning of the quarter to a high of more than $120 by the end of the year.

The report emphasized that in terms of market liquidity, Bitcoin

At the same time, the initial significant change took place in the fifth spot, with SOL overtaking Litecoin

In particular, BNB received a liquidity score of 13 despite being the third-highest-valued cryptocurrency. Moreover, BNB has dropped an additional three positions in the liquidity ranking since the third quarter of 2023. The study indicates that the majority of BNB’s liquidity is found on the Binance exchange.

Significantly, Chainlink

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.