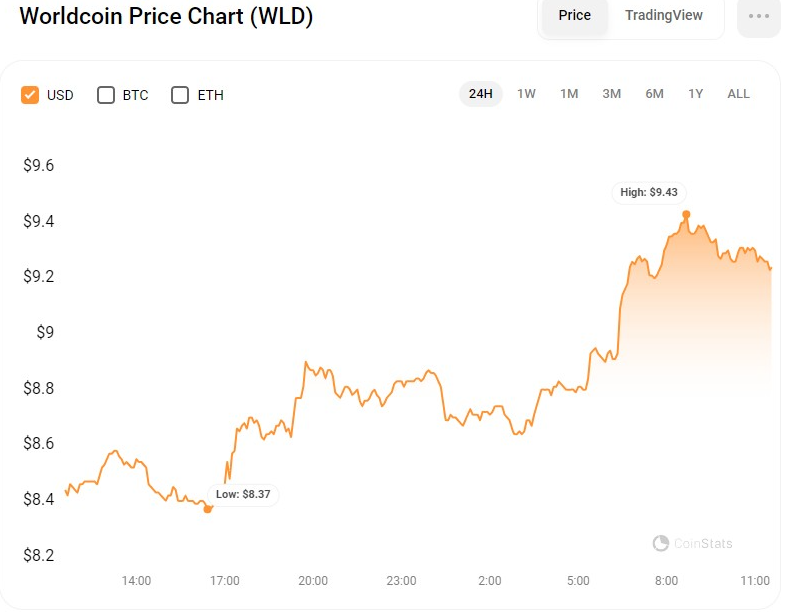

- Worldcoin’s WLD value peaks at $9.45 after Personal Custody feature launch.

- Personal Custody allows users to store their data privately on personal devices.

- Technical indicators suggest a bullish trend for WLD with increased market activity.

Introducing its Personal Custody feature has led to a significant rise in Worldcoin’s

This new feature is introduced against a backdrop of heightened privacy worries and intensified regulatory examination in several nations, with a prominent prohibition taking place in Kenya. The latest addition to the cryptocurrency initiative signifies a tactical shift, concentrating on improving users’ dominion over private information and tackling the confidentiality challenges plaguing its activities.

Worldcoin’s Transition to Personal Custody

With the launch of Personal Custody, Worldcoin is making a notable change in its handling of user data. This functionality permits individuals to keep their own data, encompassing pictures and metadata utilized for creating their World ID iris codes, on their personal devices.

This initiative is a reaction to the growing call for privacy and security in today’s digital landscape, where incidents of data violations and unsanctioned access are common issues. Worldcoin is aiming to build a more secure and confidence-driven rapport with its clientele by granting them complete authority over their information.

The introduction of Personal Custody also brings sophisticated functionalities such as Facial Recognition for authentication. This capability bolsters Worldcoin’s security infrastructure by permitting individuals to confirm their identity using a process confined to their own device. This advancement represents not just progress in the protection of user information but also the creation of a technology environment centered around the user, focusing on safeguarding personal privacy and self-governance.

Tackling Issues of Privacy

In response to various privacy concerns and the challenges posed by regulatory bodies worldwide, Worldcoin has opted to discontinue the storage of personal information on its servers. This move follows a particular incident in Kenya where the government prohibited Worldcoin activities, citing concerns over safety and the privacy of data. The prohibition underscored the essential need for initiatives like Worldcoin to implement more robust data security measures and ensure they align with the regulations of the jurisdictions in which they operate.

In reaction to these issues, Worldcoin has adopted a forward-thinking strategy by instituting Personal Custody and ending the practice of optional Data Custody during visits to orbs. This strategy is designed to strengthen the initiative’s dedication to privacy and security by guaranteeing that users maintain control over their data.

WLD/USD Technical Analysis

The Vortex Indicator on the 24-hour chart for WLDUSD, which assesses the direction of the trend, signals a robust bullish trend, with the ascending trend line (colored blue) nearing a crossover above the descending trend line (colored red). This suggests an impending shift towards a positive trend as the buying pressure increases and the influence of sellers diminishes. The current pattern indicates that the bullish momentum in the WLD market is building up and could continue in the immediate future.

The Stochastic RSI has transitioned from oversold to 34.91, indicating a potential bullish reversal as the momentum shifts in favor of buyers. This shift is corroborated by the heightened trading volume recently noted, which points to a growing interest and participation among investors to push the price higher.

In addition, there has been a 10% increase in WLD’s trading volume and a 56.31% rise in its market capitalization, reaching figures of $1,468,358,030 and $434,080,770, respectively, concurrent with the price increase.

The Relative Volatility Index (RVI), a metric for assessing a security’s volatility, has shown an uptick, implying a likelihood of price ascension. As the RVI ascends past its signal line with a value of 57.68, it suggests that a bullish breakout may be imminent. This potential breakout could attract additional traders looking to capitalize on the anticipated uptrend, potentially propelling the prices even higher shortly.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.