- US inflation data indicating a 0.5% rise in PPI subdues investor excitement.

- Cryptocurrency market faces uncertainty amid potential US recession in 2023.

- SNX, RPL, MNT, TON, and GMX tokens experience a downward trend.

The release of US inflation data, indicating a 0.5% rise in the Producer Price Index (PPI) for September, has subdued investor excitement. This unfavorable information has created a sense of uncertainty in the cryptocurrency market.

The consensus among key institutions that the United States is heading towards a recession in 2023 is increasing worries. Despite the ongoing trends of inflation and interest rates, the anticipation of additional rate hikes has kept investors on their toes, as seen in the inconsistent performance of the stock market.

Notably, the prices of SNX, RPL, MNT, TON, and GMX tokens have been experiencing a downward trend, mirroring the overall slump in the cryptocurrency market. This decrease in cryptocurrency values has raised concerns among investors who had previously reaped substantial profits.

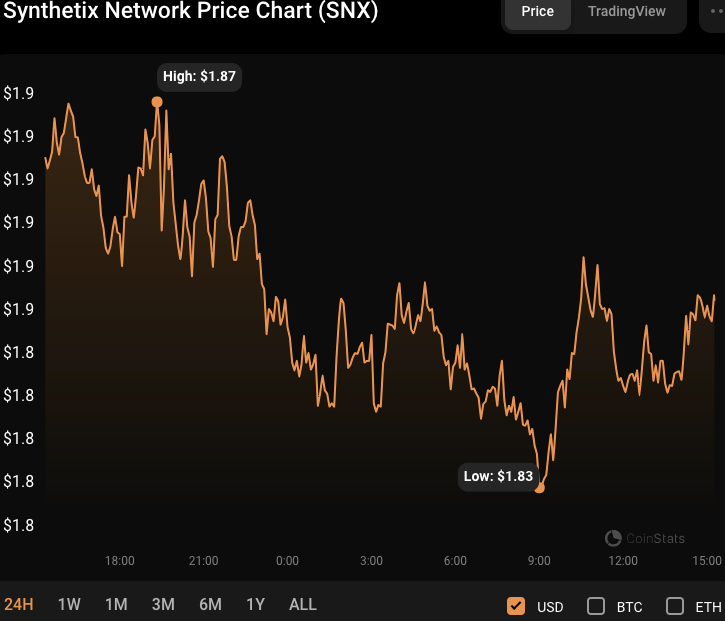

SNX/USD Technical Analysis

The bearish pressure in the Synthetix

As a result, the market value of SNX decreased to $501,011,983, while its 24-hour trading volume declined to $17,530,781. Should the negative momentum breach the $1.83 support level, SNX could drop further and challenge the subsequent support level at $1.80.

Nonetheless, should purchasers enter the market and elevate the price beyond $1.88, it could suggest a potential reversal and an optimistic outlook for SNX in the short term.

RPL/USD Technical Analysis

Despite an optimistic opening, Rocket Pool

Should RPL persistently face selling pressure at $17.92, it could potentially drop to the next support level at $17.50. Conversely, if the buyers regain dominance and elevate the price beyond $18.60, it could signal a positive shift, suggesting a potential short-term upward trajectory for RPL.

Amid the bearish trend, the market capitalization and 24-hour trading volume of RPL experienced a decrease of 2.68% and 9.95%, respectively, falling to $354,372,046 and $2,305,532.

MNT/USD Technical Analysis

The cryptocurrency Mantle

The market capitalization and 24-hour trading volume of MNT experienced a decrease of 4.83% and 5.83%, respectively, settling at $1,026,763,575 and $29,507,666 due to unfavorable market sentiment. Should the bearish trend breach the $0.3327 support level, the subsequent level to watch would be approximately $0.3200. This could exert further downward pressure on the MNT price.

GMX/USD Technical Analysis

The GMX

Despite a 4.61% decrease in GMX’s market capitalization to $320,021,901, there was a 12.22% increase in the 24-hour trading volume to $8,798,236, suggesting heightened trading activity. Even amidst a price drop, this rise in trading volume signifies that the GMX market maintains substantial demand and liquidity.

TON/USD Technical Analysis

The value of Toncoin

TON’s market cap experienced a decrease of 1.965 percent, bringing it down to $6,705,912,507, while its 24-hour trading volume saw a significant rise of 78.56%, reaching $22,092,727. Despite this, the bearish trend was still evident at the time of reporting, as shown by the 1.98% fall to $1.95.

Should the downward momentum breach the $1.92 support threshold, TON could find its next support level near $1.85.

Historically, this level has acted as a strong support during previous market downturns, potentially attracting buyers looking for a chance to enter. Nonetheless, if the downward trend continues, TON could drop to the $1.80 level, offering additional support.

In summary, the cryptocurrency markets are encountering challenges due to economic instability. However, possible SNX, RPL, MNT, GMX, and TON reversals offer prospects for astute investors.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.