According to Gabor Gurbacs, the Strategy Advisor at VanEck Associates Corporation, foreign central banks are offloading their U.S. Treasuries. However, in a surprising turn of events, the largest buyer of these assets is none other than the asset-backed stablecoin Tether. This revelation was shared by Gurbacs on his Twitter account, highlighting the growing popularity and influence of stablecoins in the global financial landscape.

Gurbacs noted that “Tether’s holdings of U.S. treasuries would rank it among the top 30 countries.”

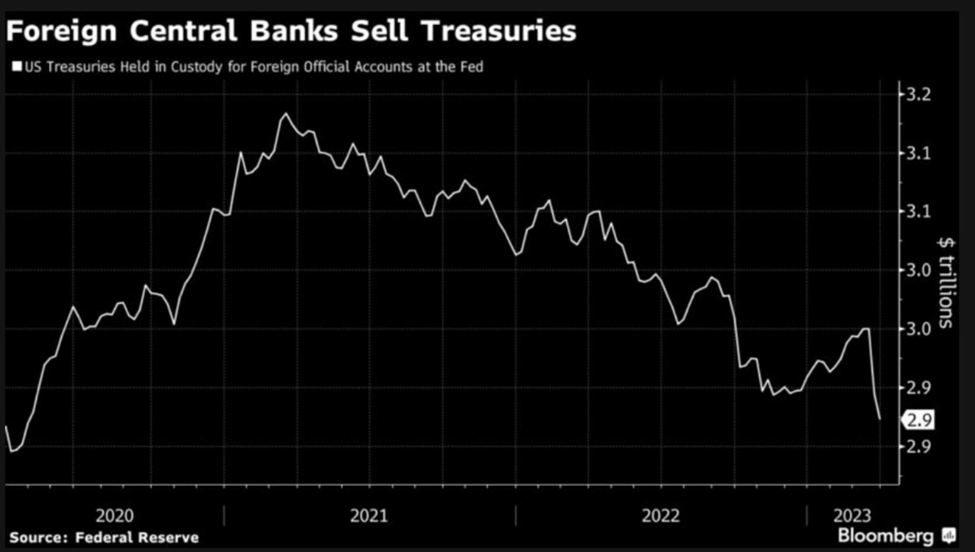

As per the latest findings by Bloomberg’s television media, foreign central banks have been divesting their Treasury holdings, thereby enabling the Federal Reserve to inject cash into the system and alleviate the ongoing banking crisis.

Recent reports show a significant drop in foreign holdings of Treasury securities, with a staggering $76 billion decrease in the week ending March 22. This marks the largest weekly decline since 2014, highlighting the potential impact of global economic factors on the U.S. Treasury market.

Joseph Abate, the esteemed Managing Director of Barclays, a renowned British multinational universal bank, made a noteworthy statement regarding the borrowing. He emphasized that the borrowing was a precautionary measure, indicating the bank’s prudence and foresight in managing its finances. His professional tone and insightful comment reflect the bank’s commitment to responsible financial practices.

The central bank wanted to build a war chest of available dollars in case the banking crisis deteriorated but did not want to fire sell its Treasuries.

According to Gurbacs, Tether has acquired a significant portion of U.S. Treasuries, and he believes that the U.S. government should acknowledge and value Tether’s contribution to the economy. Gurbacs presented a graph to support his claim depicting the U.S. Treasuries sold by foreign central banks, previously shared by renowned investor Willem Middelkoop.

According to Middelkoop, foreign banks have been offloading their Treasuries, with Russia having almost sold out completely and China continuing to do so. He suggested that the FED may soon need to step in as a buyer once again, highlighting that debt monetization should be considered a last resort.