- Ethereum’s EIP-4844 upgrade reduces gas fees and improves scalability.

- Layer-2 cryptocurrencies like Synthetix, Optimism, and Arbitrum see significant price surges.

- Bullish momentum observed in SNX, OP, and ARB with potential for further price appreciation.

The recent implementation of Ethereum’s (ETH) EIP-4844 upgrade is expected to impact layer-2 cryptocurrency projects shortly positively. This upgrade specifically focuses on addressing the issue of high gas fees associated with transactions by introducing a unique transaction type. As a result, we anticipate a potential rally in layer-2 projects as they benefit from reduced transaction costs and improved scalability.

EIP-4844 is poised to enhance the benefits of Layer-2 scaling solutions by prioritizing the reduction of gas fees on Ethereum’s beacon chain. As a result, this upgrade is expected to attract a substantial influx of investors keen on participating in Layer-2 chains like Optimism, Arbitrum, Synthetix, and others.

Over the course of the last 24 hours, the majority of Layer-2 cryptocurrencies experienced significant gains. Notably, Synthetix (SNX), Optimism (OP), and Arbitrum (ARB) witnessed a substantial surge in their prices during the recent trading session, as reported by CoinMarketCap.

Synthetix (SNX)

SNX experienced a surge in the past 24 hours, reaching a peak of $2.82. This cryptocurrency witnessed a significant increase of approximately 3.91% yesterday. Throughout this upward movement, the altcoin’s value climbed from a low of $2.593 to a high of $2.833. However, it retraced slightly and concluded the day with a closing price of $2.712. The altcoin’s value has continued to rise marginally, trading at $2.72.

SNX’s daily chart has recently shown a bullish descending wedge pattern formation. If this pattern is confirmed within the next two weeks, it has the potential to trigger an upward breakout. Such a move could lead to SNX’s price surpassing the significant resistance level at $2.902 and potentially even challenging the resistance at $3.154.

However, should the price of SNX close a daily candle below the critical support level of $2.544, it is highly probable that the bullish hypothesis will be invalidated, potentially exposing the cryptocurrency to a decline towards the subsequent significant support level at $2.325 within the next 48 hours.

SNX’s daily chart exhibited a persistent bullish momentum, as evidenced by the 9-day EMA line maintaining a position above the 20-day EMA line at the time of analysis. This indicates that SNX is experiencing a short-term bullish cycle, potentially leading to a price surge in the coming days.

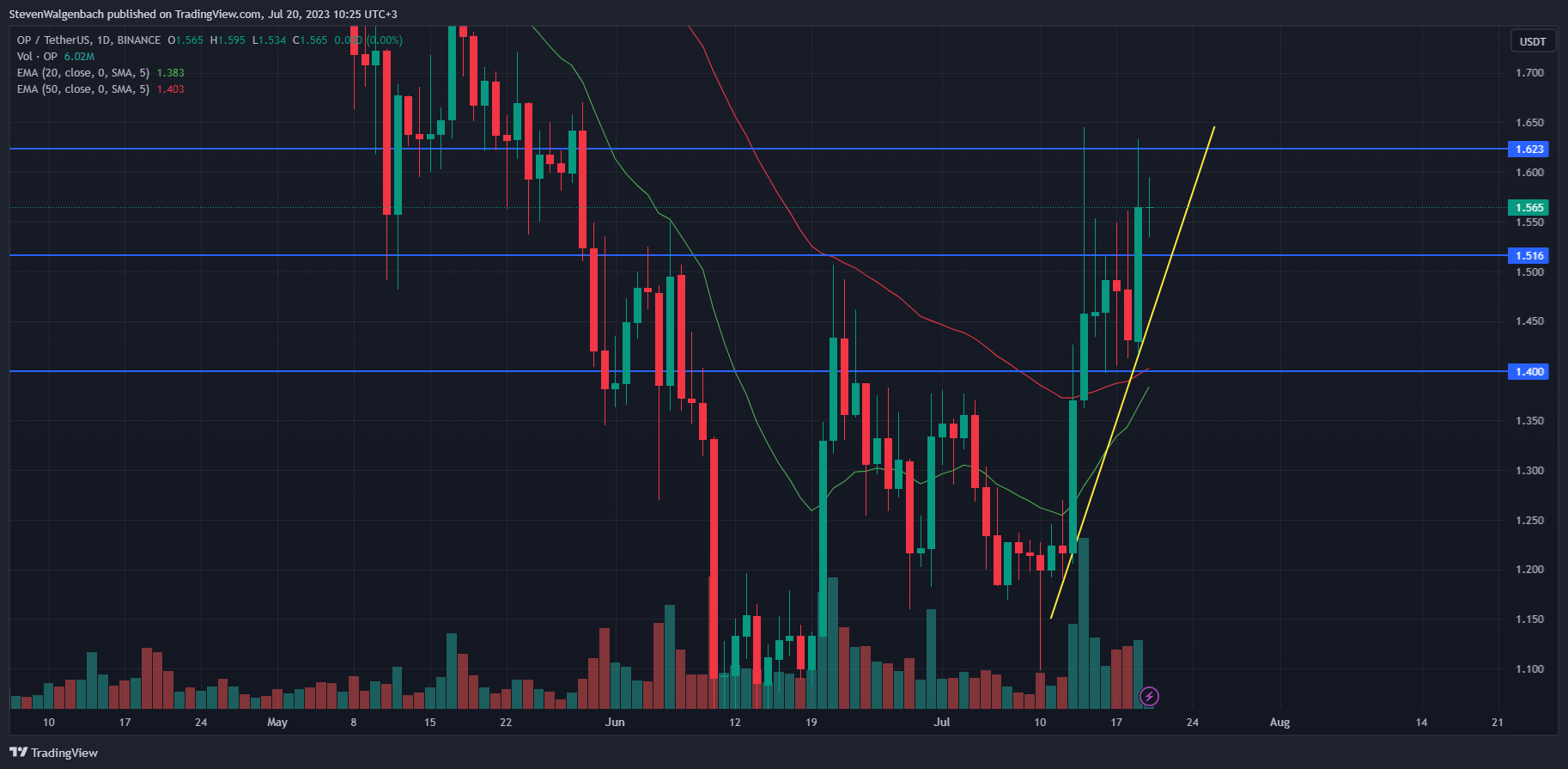

Optimism (OP)

Over the past 48 hours, the price of OP experienced a significant surge of over 9%, climbing from a low of $1.417 to a peak of $1.633 yesterday. However, it retraced slightly and concluded the day with a closing price of $1.565.

As of the latest update, the price of OP stood at $1.56. Despite this, the altcoin demonstrated a notable increase of approximately 4.46% within the last 24 hours. Notably, OP exhibited a positive trend against Bitcoin (BTC) and Ethereum (ETH), the two prominent cryptocurrencies in the market, with gains of 4.17% and 4.67%, respectively.

The daily chart of OP displayed a promising upward trend as the altcoin consistently recorded higher lows over the last fortnight. Moreover, the price surge witnessed in the past 48 hours led to OP successfully surpassing the significant resistance level at $1.516, which subsequently transformed into a support level as the altcoin continued to trade above this threshold at the time of writing.

If the bullish momentum persists over the next 48 hours, OP can surpass the resistance level at $1.623. However, there might be a price correction within the cryptocurrency market in the next 24 hours, as traders may opt to capitalize on the recent price surge and secure their profits.

In the event of such an occurrence, the altcoin could revisit the previously mentioned price level of $1.516. However, even in the case of a potential correction, the bullish thesis remains valid as long as the altcoin manages to close today’s daily candle above this significant price point. Failure to do so may result in a decline to $1.40 within the coming days.

Based on the current market conditions, a bullish trend is likely to materialize. This is supported by the 20-day Exponential Moving Average (EMA) line’s attempt to surpass the 50-day EMA line at the time of analysis. If these two crucial technical indicators intersect, it would indicate that the cryptocurrency in question has entered a medium-term bullish trajectory, potentially leading to further price appreciation in the coming days.

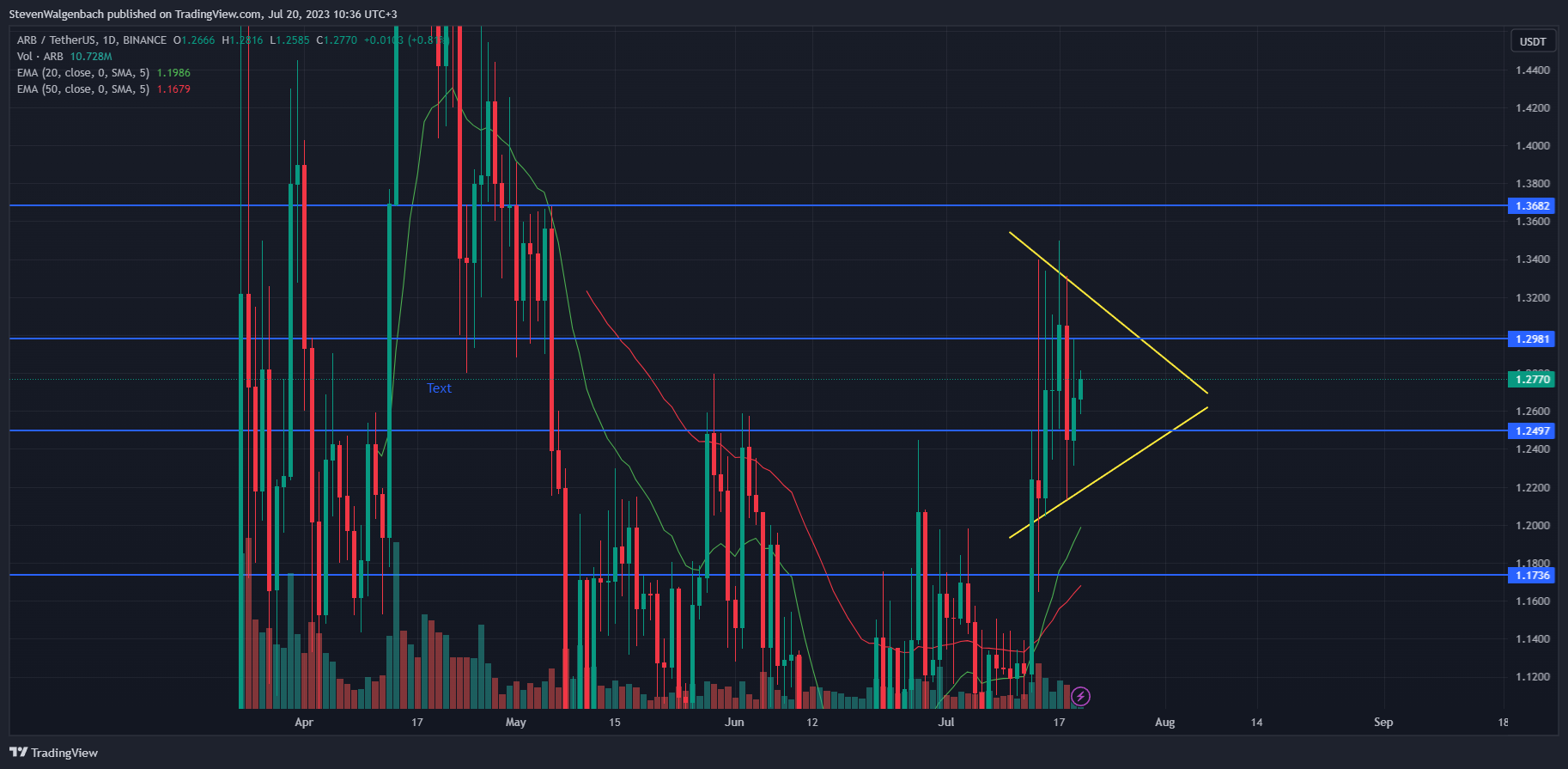

Arbitrum (ARB)

Yesterday, the price of ARB experienced a notable increase of 1.73%, reaching a peak of $1.2976. However, bears exerted downward pressure on the altcoin, causing it to conclude the trading session at $1.2667. Subsequently, the cryptocurrency’s value slightly rose to $1.27 at the time of writing. Consequently, the altcoin’s price exhibited a 0.84% increase over the past 24 hours.

There is a potential for a significant upward movement in ARB in the upcoming week, as evidenced by the formation of a wedge pattern on the altcoin’s daily chart. This pattern emerged after the cryptocurrency’s price consistently recorded higher lows and lower highs over the past five days.

If there is a bullish breakout, ABR’s price has the potential to surpass the major resistance level at $1.2981 and establish it as a new support level. It could also test the next significant milestone at $1.3682 in the upcoming week. Conversely, a bearish breakout might result in the cryptocurrency’s price declining to $1.1736 within the next few days.

The alignment of the 20-day and 50-day EMA lines confirmed the bullish outlook, with the shorter-term indicator positioned above the longer-term 50-day EMA line at the current moment. Furthermore, the expanding gap between these two EMAs indicates a strengthening medium-term bullish momentum.

In recent developments, the aggregate market capitalization of Layer-2 cryptocurrencies witnessed a notable surge of 3.2% during the previous trading day. This impressive growth propelled the cumulative value to an estimated $11,312,673,901, as reported by the renowned cryptocurrency data platform, CoinMarketCap.

Polygon (MATIC), the dominant player in the cryptocurrency category, experienced a notable surge of over 4% in its price within the last 24 hours. This impressive growth propelled its weekly performance even higher, reaching an impressive +7.21% in the green zone. Consequently, the altcoin was valued at $0.7792, a marginal deviation from its peak of $0.7796 earlier in the day.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.