- Ethereum L2 transaction fees drop post-Dencun Upgrade.

- Ethereum Layer 2 solutions see record transaction volumes.

- Skepticism arises over Ethereum’s value amidst L2 fragmentation concerns.

The current atmosphere regarding Ethereum and its native cryptocurrency, Ether

Examining the L2 ecosystem more closely will help us understand Ethereum’s core issues.

Transaction Costs on L2s Reduced by 99%

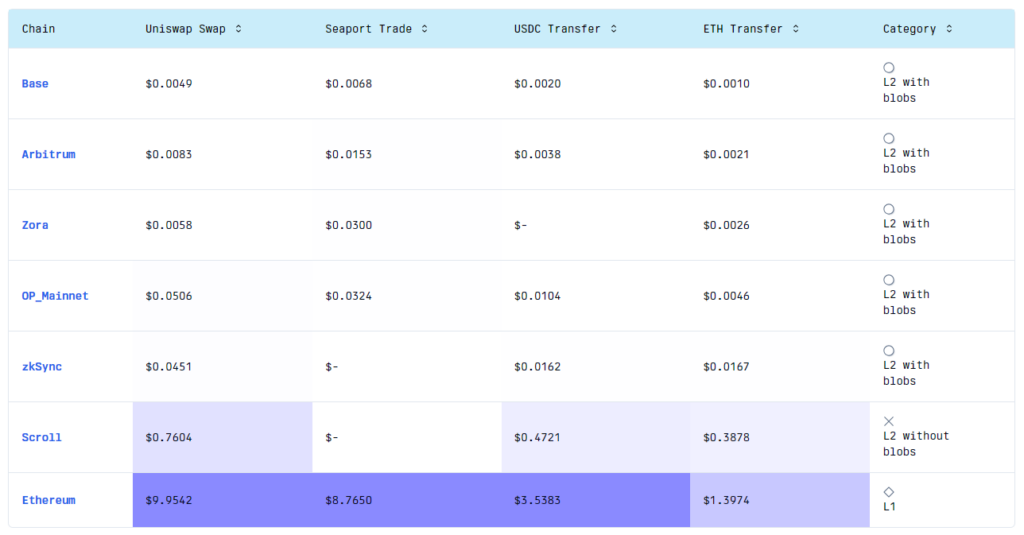

Following the Dencun Upgrade on March 13, Ethereum integrated blobs (Binary Large Objects) through the adoption of EIP-4844. This enhancement improved data availability and led to a significant decrease in transaction fees across the L2 networks, a development that should bring a sense of relief to investors and traders. Subsequent to this upgrade, networks such as OP Mainnet (Optimism), Base, Arbitrum, Zora, and zkSync witnessed a marked decrease in gas fees for various operations, including swaps, transfers, and similar activities.

The data from GasFees.io indicates that the average cost for transferring ETH on Base is $0.0011 while exchanging tokens costs $0.0049. On the Arbitrum network, the fees are $0.0085 for transfers and $0.0021 for token swaps. Zora charges $0.0058 for transfers and $0.0026 for token swaps, and OP Mainnet’s fees are $0.0046 for transfers and $0.0508 for token swaps.

Layer 2 Solutions Reach Record Highs

The surge in Memecoins trading has significantly driven the usage of these Ethereum Layer 2 solutions, leading to record-breaking transaction volumes. Notably, the transaction volume on Consensys’s Ethereum Layer 2 solution, zkEVM rollup Linea, has increased by 678%, and Coinbase’s Base has seen a 605% increase over the previous month, according to data from growthepie.xyz. It’s important to note that asset management firm VanEck has forecasted that Ethereum Layer 2 solutions will reach a market valuation of one trillion dollars by 2030.

Concerns and Negative Remarks Directed Towards Ethereum

Ethereum is the target of disparagement and derision. Veteran trader Peter Brandt pointed out defects in its system and dismissed ETH as a “worthless coin.” Similarly, the well-known Solana group Superteam DAO released a promotional clip on Wednesday, taking aim at Ethereum. The video ridiculed ETH enthusiasts and developers, branding them as victims of Ethmaximymsis (or ‘ETHMAXI’). Despite its shortcomings, it suggested that ETH developers should switch to developing on Solana using Wormhole.

Another issue is the potential for Ethereum to lose its ability to capture value due to the increasing ‘L2 fragmentation.’ Highlighting this issue, the anonymous cryptocurrency investor “@0xSisyphus” drew parallels to the situation with ATOM, the core token of the interoperable Cosmos networks, and DOT, the token of the parachain-centric Polkadot. In contrast, a well-known ETH educator is championing the emergence of a modular Ethereum landscape, with ETH as the driving force.

In the midst of these events, the price of Ether (ETH) continues to fluctuate around the $3.2K mark. At the moment of this report, it is priced at $3,269, having experienced a 2.4% decline over the past day. Importantly, data from Into The Block for Q1 2023 shows that nearly $4 billion in ETH was moved off various cryptocurrency exchanges. This trend of holders accumulating ETH, a clear sign of their positive sentiment, should inspire optimism. Additionally, anticipation is building as discussions progress regarding ETH’s regulatory classification and the Securities and Exchange Commission’s pending decision on Ethereum-based spot ETFs.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.