- Solana’s daily stablecoin transfer volume hits $16.6 billion, surpassing Ethereum and others.

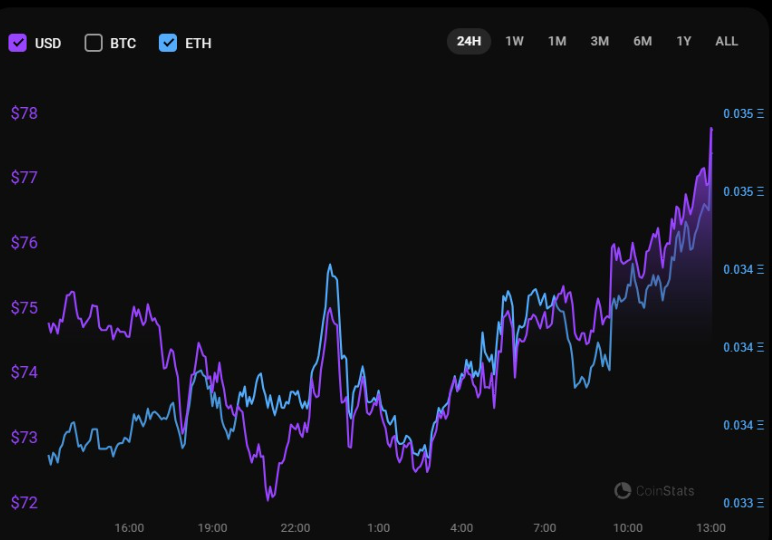

- Solana’s price increases to $76.66 with a 2.07% growth in 24 hours.

- Solana’s DeFi Total Value Locked (TVL) surpasses $1 billion after tripling.

Recently, Solana

Throughout 2022, the amount of money transferred daily varied, ranging from $33 million to $743 million, but it never exceeded one billion dollars. Nirmal Krishnan, who leads the Engineering team at Artemis, highlighted this expansion by saying:

The JTO airdrop on December 7 was a catalyst, propelling Solana ahead of Ethereum in terms of DEX and NFT trading volume

The increase in stablecoin transactions reflects the growing movement and liquidity in the Solana network. Solana’s status is strengthened by Circle, a key issuer of USD Coin (USDC), recently adding the Euro Coin (EURC). This progress creates an ideal environment for the growth of decentralized finance platforms and digital wallets on Solana, improving its attractiveness and functionality.

The effects of these advancements are clear in Solana’s market behavior. Solana is currently trading at $76.66, with a trading volume exceeding $2 billion in the last 24 hours, representing a growth of 2.07%, according to CoinStats. On the other hand, Ethereum, which has a bigger market capitalization, has experienced a decline of 1.19%, with its trading price at $2,217.54 and a trading volume of more than $10 billion.

The rebound in the price of Solana has led to a renewed increase in its blockchain operations. There has been a notable rise in both the number of transactions on the network and its total value locked (TVL). Since hitting a low in September 2023, the price of SOL has increased by over three times. In line with this, the DeFi TVL for Solana, according to data from DeFiLlama, has also seen a threefold increase from its July 2023 levels, now surpassing the $1 billion mark.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.